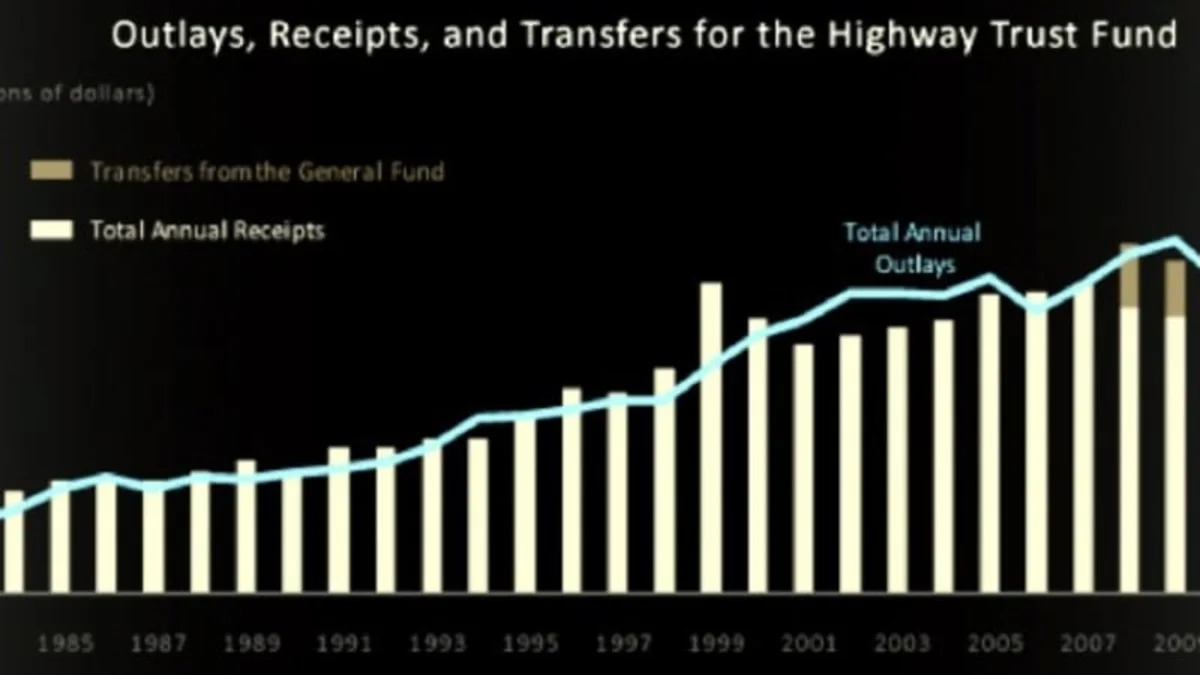

As you can see in the chart above, the Fund has not taken in more money than it spent since 2001, except for one time in 2006. In 2008, 2009 and 2010, the Highway Fund got money from the General Fund to pay for things like highway repairs and various mass transit programs.

Since the Highway Trust Fund is mostly paid for by the gas tax, that number plays a big roll in how much money America has to build bridges. Before we move on, though, it's time for a question: What was the last year the U.S. gas tax was raised? The answer and more can be found below.

The correct answer? 1993, which means it's been almost 20 years since the gas tax was pegged at 18.4 cents per gallon. An even bigger problem is that it is a set rate, not a percentage or in any way indexed for inflation, so the absolute value of the money collected has only dropped since 1993.

This week, the CBO issued a new report that looked at how the upcoming, higher CAFE fuel economy rules will affect the Highway Trust Fund. The short answer? Between 2012 and 2022, the Fund will see revenues that are $57 billion lower than they would be without the new CAFE rules. The slightly longer answer:

The proposed CAFE standards eventually would cause a significant reduction in in fuel consumption by light-duty vehicles. That decrease in fuel consumption would result in a proportionate drop in gasoline tax receipts: CBO estimates that the proposed CAFE standards would gradually lower gasoline tax revenues, eventually causing them to fall by 21 percent. That full effect would not be realized until 2040 because the standards would gradually increase in stringency (only reaching their maximum level in 2025) and because the vehicle fleet changes slowly as older vehicles are replaced with new ones.

To illustrate the effect that the standards would eventually have on the trust fund's cash flows (in 2040 and beyond), CBO examined how a 21 percent reduction in gasoline tax collections would alter the agency's current budget projections for the trust fund, which span the period from 2012 through 2022. CBO estimates that such a decrease would result in a $57 billion drop in revenues credited to the fund over those 11 years, a 13 percent reduction in the total receipts credited to the fund.

The CBO suggests three ways to deal with the shortfalls: do nothing (i.e., keep on transferring money from the general fund), spend less on highways and mass transit or raise the gas tax (or other taxes and direct them to the Fund). An increase to the gas tax wouldn't have to be huge. Just five cents a gallon would be enough to offset the $57 billion, the CBO says. But until Congress can agree on this simple change, there's always the voluntary gas tax.

Sign in to post

Please sign in to leave a comment.

Continue