The Auto Alliance does not like feebates as a way to get cleaner vehicles on the road. Dave McCurdy, Alliance president & CEO, says a "feebate tax" [his words] is not the way to enact change. Why does the Alliance feel the need to speak out against feeble? Because the California Air Resources Board is considering adopting them and has tasked researchers at the University of California – Davis to report on the feasibility of such a program. The UC Davis team released an interim statement of research findings called "Potential Design, Implementation, and Benefits of a Feebate Program for New Passenger Vehicles in California" last month. Here's how the researchers define the term:

[Source: UC Davis, Auto Alliance]

PRESS RELEASE

Proposed Car "Feebate" Tax Raises Pocketbook Concerns

National Program Already Reduces Auto CO2 Dramatically

Washington, DC – Automakers responded to California's proposed car "feebate" tax today by saying this is not the time for another government program that will put consumers further in debt or drive up the government deficit. The program of feebate taxes being considered by California has proved to be costly to consumers in both Canada and France.

"Since automakers are investing heavily in more fuel-efficient autos, we want to put more of them on the road....to improve the environment, to reduce our dependence on foreign oil and to strengthen our bottom line. But a feebate tax is not the way to do it," said Dave McCurdy, president & CEO, Alliance. "Experience in France and Canada shows that feebate taxes raise costs to consumer one way or another, either through an extra fee paid when buying a new car or through higher income taxes to fund the program."

The proposed California feebate tax raises several concerns for consumers:

· Consumers understand that feebates are taxes. Feebate proposals have been discussed since 1989 and there is a reason they are rarely adopted: in other countries, feebates have become just another source of revenue for the government or a reason to raise taxes. Canada started a feebate program in 2007, and within two years, Canada ended the consumer rebates, or subsidies, but kept the consumer fees, or taxes. In France, taxpayers are subsidizing the feebate program. Rebates are exceeding fees paid, so the French program cost taxpayers 600,000 Euros in 2009 (or about $800 million).

· There already is a nationwide program. In April, EPA and NHTSA finalized a new multi-year national standard to reduce carbon dioxide (CO2) and fuel use through 2016. Just last week, on May 21, automakers joined federal policymakers at the White House to launch the next phase of coordinated NHTSA and EPA regulations to address fuel economy and greenhouse gas emissions through 2025. Since there is a new national mileage/CO2 standard for autos, the proposed state feebate represents another layer of government regulations on top of existing government regulations.

· The feebate will have unintended consequences. Many consumers feel there are already too many additional costs and government fees when buying a new vehicle. If the government

imposes these fees on new cars, consumers will either hold on to their older (less efficient) cars longer, or choose to buy a used vehicle to avoid the extra tax.

· A feebate always ends up penalizing somebody unfairly. If the government determines who gets rebates and who pays fees by vehicle size, there is an extra tax burden on farmers, tradesmen, small business and large families who depend on these vehicles. If the government decides who wins and who loses by picking the best and worst performers in each vehicle class, then there will be a situation where a small car will carry a fee while a pickup truck generates a rebate.

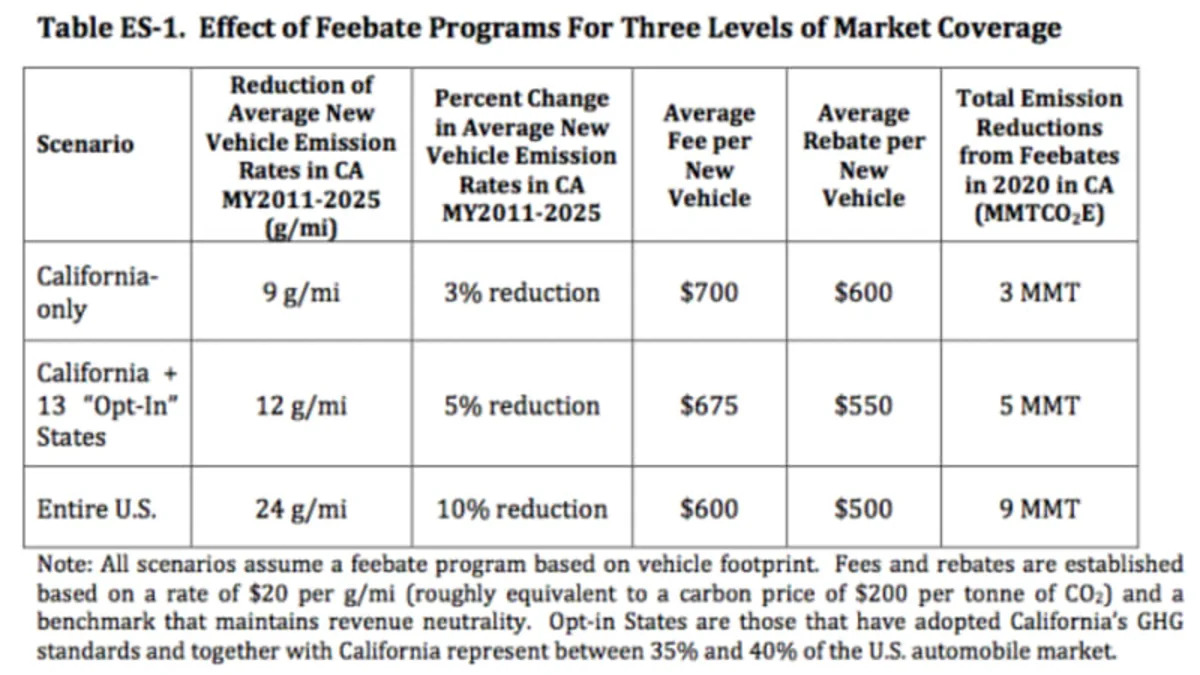

So, basically, if you want to buy a dirty vehicle, you pay more. If you choose a clean ride, you get to pocket some of the money those gas guzzler drivers paid. Over all, the researchers found, "feebate programs reduce emissions at a net negative social cost" while admitting that, "new vehicle sales in California would decline under all feebate programs, resulting in industry revenues falling on the order of 1 percent or several hundreds of million dollars to one billion dollars per year." The Alliance has its own issues with the report, and points to four main problems:Feebates are market-based policies for encouraging emissions reductions from new passenger vehicles by levying fees on relatively high-emitting vehicles and providing rebates to lower-emitting vehicles.

- Feebates are just another word for taxes, and have not worked as expected in other countries, specifically France and Canada.

- A nationwide program for reducing greenhouse gases already exists.

- There will be unintended consequences.

- Lastly, "a feebate always ends up penalizing somebody unfairly." The Alliance says that farmers, tradesmen, small business and large families will be hurt by the program.

[Source: UC Davis, Auto Alliance]

PRESS RELEASE

Proposed Car "Feebate" Tax Raises Pocketbook Concerns

National Program Already Reduces Auto CO2 Dramatically

Washington, DC – Automakers responded to California's proposed car "feebate" tax today by saying this is not the time for another government program that will put consumers further in debt or drive up the government deficit. The program of feebate taxes being considered by California has proved to be costly to consumers in both Canada and France.

"Since automakers are investing heavily in more fuel-efficient autos, we want to put more of them on the road....to improve the environment, to reduce our dependence on foreign oil and to strengthen our bottom line. But a feebate tax is not the way to do it," said Dave McCurdy, president & CEO, Alliance. "Experience in France and Canada shows that feebate taxes raise costs to consumer one way or another, either through an extra fee paid when buying a new car or through higher income taxes to fund the program."

The proposed California feebate tax raises several concerns for consumers:

· Consumers understand that feebates are taxes. Feebate proposals have been discussed since 1989 and there is a reason they are rarely adopted: in other countries, feebates have become just another source of revenue for the government or a reason to raise taxes. Canada started a feebate program in 2007, and within two years, Canada ended the consumer rebates, or subsidies, but kept the consumer fees, or taxes. In France, taxpayers are subsidizing the feebate program. Rebates are exceeding fees paid, so the French program cost taxpayers 600,000 Euros in 2009 (or about $800 million).

· There already is a nationwide program. In April, EPA and NHTSA finalized a new multi-year national standard to reduce carbon dioxide (CO2) and fuel use through 2016. Just last week, on May 21, automakers joined federal policymakers at the White House to launch the next phase of coordinated NHTSA and EPA regulations to address fuel economy and greenhouse gas emissions through 2025. Since there is a new national mileage/CO2 standard for autos, the proposed state feebate represents another layer of government regulations on top of existing government regulations.

· The feebate will have unintended consequences. Many consumers feel there are already too many additional costs and government fees when buying a new vehicle. If the government

imposes these fees on new cars, consumers will either hold on to their older (less efficient) cars longer, or choose to buy a used vehicle to avoid the extra tax.

· A feebate always ends up penalizing somebody unfairly. If the government determines who gets rebates and who pays fees by vehicle size, there is an extra tax burden on farmers, tradesmen, small business and large families who depend on these vehicles. If the government decides who wins and who loses by picking the best and worst performers in each vehicle class, then there will be a situation where a small car will carry a fee while a pickup truck generates a rebate.

Sign in to post

Please sign in to leave a comment.

Continue