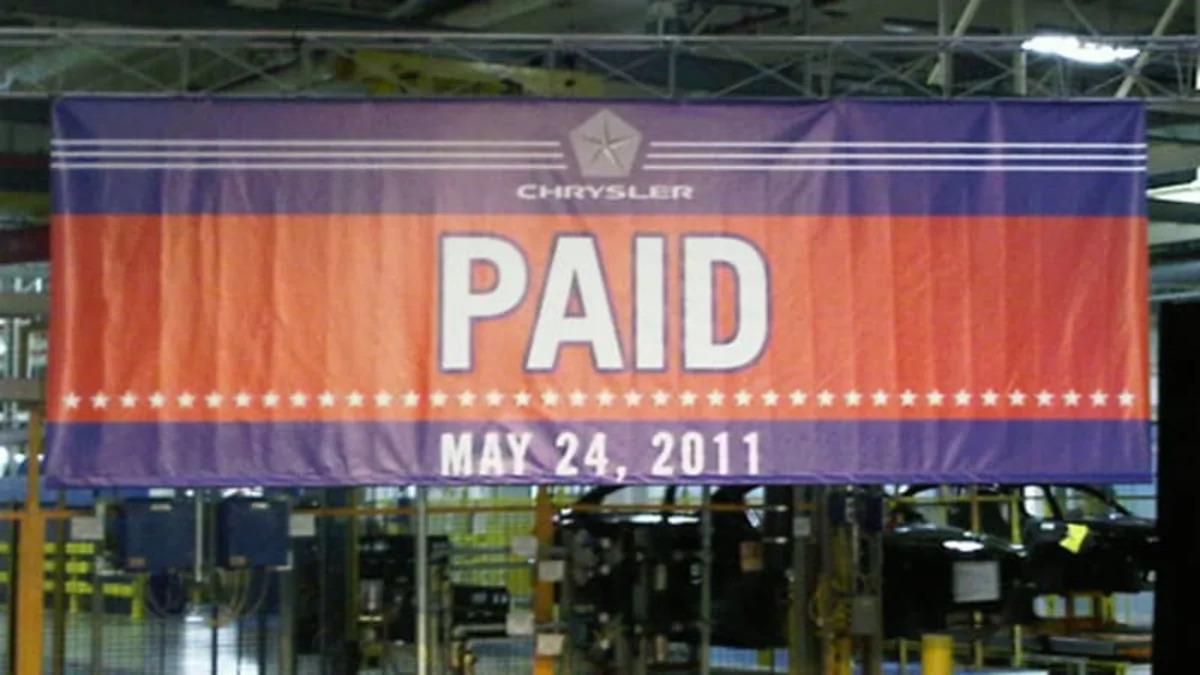

It's Official: Chrysler has announced that it has repaid its multi-billion dollar obligations owed to both the United States and Canadian governments. Adding up both loans plus interest, Chrysler has just shelled out a tidy $7.6 billion. The U.S. receives $5.9 billion and Canada will get $1.7 billion.

Chrysler was able to secure new means of financing, which allows the automaker to pay off its government obligations a full six years ahead of the original payment schedule. While this new financing still involves debts, it saves Chrysler an estimated $350 million per year in interest. This move also allows Chrysler to remain liquid, with more than $10 billion in assets ready to roll.

Under the direction of the U.S. government, Chrysler partnered up with Fiat, and the goal was to bring smaller, more fuel-efficient vehicles to the states. Yet as an opinion piece in The Detroit News sagely reminds us, it wasn't really the smaller cars that helped Chrysler, but the newly refreshed sport utility vehicles. The all-new Dodge Durango and Jeep Grand Cherokee models helped push sales up 17 percent in 2010.

Regardless of how they got there, this move should serve to instill confidence in the U.S. car-buying public. Chrysler continues to add new or redesigned vehicles to its lineup and has a strong media campaign behind those vehicles. Will high gas prices slow the positive momentum that Chrysler has built up, or is this the chance for the Fiat portion of the relationship to step up and shine? Sound off in Comments, and check out the full press release posted after the jump.

Chrysler was able to secure new means of financing, which allows the automaker to pay off its government obligations a full six years ahead of the original payment schedule. While this new financing still involves debts, it saves Chrysler an estimated $350 million per year in interest. This move also allows Chrysler to remain liquid, with more than $10 billion in assets ready to roll.

Under the direction of the U.S. government, Chrysler partnered up with Fiat, and the goal was to bring smaller, more fuel-efficient vehicles to the states. Yet as an opinion piece in The Detroit News sagely reminds us, it wasn't really the smaller cars that helped Chrysler, but the newly refreshed sport utility vehicles. The all-new Dodge Durango and Jeep Grand Cherokee models helped push sales up 17 percent in 2010.

Regardless of how they got there, this move should serve to instill confidence in the U.S. car-buying public. Chrysler continues to add new or redesigned vehicles to its lineup and has a strong media campaign behind those vehicles. Will high gas prices slow the positive momentum that Chrysler has built up, or is this the chance for the Fiat portion of the relationship to step up and shine? Sound off in Comments, and check out the full press release posted after the jump.

Chrysler Group LLC Completes Refinancing and Repays U.S. and Canadian Government Loans in Full

More than six years ahead of schedule, Chrysler Group fulfills promise to taxpayers and repays original government loans totaling $6.7 billion, in addition to $1.8 billion of interest and other consideration

Intervention by U.S. and Canadian governments and strategic alliance with Fiat leads to 16 all-new or significantly refreshed vehicles currently in dealerships; more than $3 billion in facility upgrades; and increased employment with the hiring of 6,000 Chrysler Group employees

Company's return to profitability and double-digit worldwide sales increases show new product lineup gaining momentum in marketplace

May 24, 2011 , Auburn Hills, Mich. -

Chrysler Group LLC today announced the repayment of $7.6 billion in outstanding U.S. and Canadian government loans following the completion of new refinancing transactions. The original loans were repaid in full, more than six years ahead of schedule, along with the payment of accrued interest and additional consideration.

Today, the Company made payments of $5.9 billion to the U.S. Treasury (UST) and $1.7 billion to Export Development Canada (EDC) to retire the loans granted when Chrysler Group began operations in June 2009. EDC is the holding company through which the Canadian federal and Ontario provincial governments extended loans to Chrysler Group.

The Company borrowed $5.1 billion from the UST and $1.6 billion from the Canadian governments in June 2009 ($2.6 billion from the original loan facilities was undrawn and the facilities will be canceled). In total, Chrysler Group has paid the UST $6.5 billion and the EDC $2.0 billion, including $1.8 billion in interest and additional consideration.

"Less than two years ago, we made a commitment to repay the U.S. and Canadian taxpayers in full and today we made good on that promise," said Sergio Marchionne, Chief Executive Officer, Chrysler Group LLC. "The loans gave us a rare second chance to demonstrate what the people of this Company can deliver and we owe a debt of gratitude to those whose intervention allowed Chrysler Group to re-establish itself as a strong and viable carmaker.

"Paying back the loans, along with the financial community's investment in our refinancing packages, marks another step in the Company returning as a competitive force in the global automotive industry."

Chrysler Group confirmed the completion of new financing transactions consisting of a term loan totaling $3.0 billion, debt securities totaling $3.2 billion and a revolving credit facility of $1.3 billion. The new financing will save Chrysler Group an estimated $350 million a year in interest expenses.

The Company used the net proceeds from the term loan and bonds, together with $1.3 billion from an equity call option exercised by Fiat for an incremental 16 percent fully diluted ownership interest, to repay the government loans. The revolving credit facility remains undrawn.

Chrysler Group continues to have more than $10 billion in liquidity after the refinancing and loan payoffs, which includes the undrawn revolving credit facility.

"Everyone in the extended Chrysler Group family, from employees to union partners to dealers and suppliers, have worked tirelessly to deliver on our promises and to win back public trust in the Company and our products," said Marchionne. "There is more work to be done as we remain focused on fulfilling the goals outlined in our 2010-2014 business plan."

Goldman, Sachs Co. advised Chrysler Group on structuring the financings and Evercore Partners advised the Company's Finance Committee.

More than six years ahead of schedule, Chrysler Group fulfills promise to taxpayers and repays original government loans totaling $6.7 billion, in addition to $1.8 billion of interest and other consideration

Intervention by U.S. and Canadian governments and strategic alliance with Fiat leads to 16 all-new or significantly refreshed vehicles currently in dealerships; more than $3 billion in facility upgrades; and increased employment with the hiring of 6,000 Chrysler Group employees

Company's return to profitability and double-digit worldwide sales increases show new product lineup gaining momentum in marketplace

May 24, 2011 , Auburn Hills, Mich. -

Chrysler Group LLC today announced the repayment of $7.6 billion in outstanding U.S. and Canadian government loans following the completion of new refinancing transactions. The original loans were repaid in full, more than six years ahead of schedule, along with the payment of accrued interest and additional consideration.

Today, the Company made payments of $5.9 billion to the U.S. Treasury (UST) and $1.7 billion to Export Development Canada (EDC) to retire the loans granted when Chrysler Group began operations in June 2009. EDC is the holding company through which the Canadian federal and Ontario provincial governments extended loans to Chrysler Group.

The Company borrowed $5.1 billion from the UST and $1.6 billion from the Canadian governments in June 2009 ($2.6 billion from the original loan facilities was undrawn and the facilities will be canceled). In total, Chrysler Group has paid the UST $6.5 billion and the EDC $2.0 billion, including $1.8 billion in interest and additional consideration.

"Less than two years ago, we made a commitment to repay the U.S. and Canadian taxpayers in full and today we made good on that promise," said Sergio Marchionne, Chief Executive Officer, Chrysler Group LLC. "The loans gave us a rare second chance to demonstrate what the people of this Company can deliver and we owe a debt of gratitude to those whose intervention allowed Chrysler Group to re-establish itself as a strong and viable carmaker.

"Paying back the loans, along with the financial community's investment in our refinancing packages, marks another step in the Company returning as a competitive force in the global automotive industry."

Chrysler Group confirmed the completion of new financing transactions consisting of a term loan totaling $3.0 billion, debt securities totaling $3.2 billion and a revolving credit facility of $1.3 billion. The new financing will save Chrysler Group an estimated $350 million a year in interest expenses.

The Company used the net proceeds from the term loan and bonds, together with $1.3 billion from an equity call option exercised by Fiat for an incremental 16 percent fully diluted ownership interest, to repay the government loans. The revolving credit facility remains undrawn.

Chrysler Group continues to have more than $10 billion in liquidity after the refinancing and loan payoffs, which includes the undrawn revolving credit facility.

"Everyone in the extended Chrysler Group family, from employees to union partners to dealers and suppliers, have worked tirelessly to deliver on our promises and to win back public trust in the Company and our products," said Marchionne. "There is more work to be done as we remain focused on fulfilling the goals outlined in our 2010-2014 business plan."

Goldman, Sachs Co. advised Chrysler Group on structuring the financings and Evercore Partners advised the Company's Finance Committee.

Sign in to post

Please sign in to leave a comment.

Continue