Tesla announced in an SEC filing this morning that it will begin accepting Bitcoin as a form of payment for its cars "in the near future." The California-based automaker further said it bought $1.5 billion in the digital cryptocurrency. According to Bloomberg, that sent the currency to a record price of $43,000.

According to the filing, Tesla's new policy was adopted to "provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity." After that decision received the blessing of Tesla's Board of Directors, the automaker made the massive investment in Bitcoin, adding that it "may acquire and hold digital assets from time to time or long-term."

This being an SEC filing, Tesla summarized the dangers of investing in the digital currency like Bitcoin, calling them "highly volatile." In other words, the price of Bitcoin could fluctuate in the future and potentially fall below the price Tesla paid for it, which could lead to the automaker losing money on the transaction when it's time to sell the Bitcoin.

Dogecoin is the people’s crypto

— Elon Musk (@elonmusk) February 4, 2021

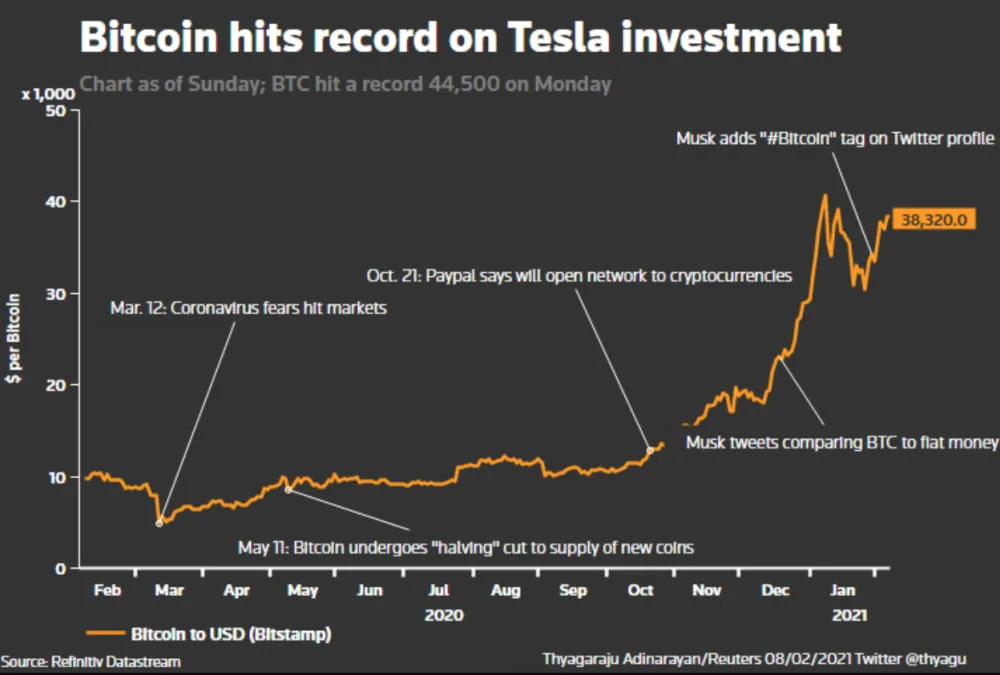

Recent tweets from Tesla chief Elon Musk may have telegraphed the automaker's interest in cryptocurrency. After adding the word Bitcoin to his Twitter bio (and then deleting in shortly thereafter), he tweeted that "Dogecoin is the people's crypto." That tweet was credited with sending the price of Dogecoin soaring, as well.

Analysts said it could help accelerate a move for bitcoin move towards the mainstream that has seen both Paypal, also co-founded by Musk, and huge global money manager BlackRock move to accept the currency.

"I think we will see an acceleration of companies looking to allocate to Bitcoin now that Tesla has made the first move," said Eric Turner, vice president of market intelligence at cryptocurrency research and data firm Messari.

"One of the largest companies in the world now owns Bitcoin and by extension, every investor that owns Tesla (or even just an S&P 500 fund) has exposure to it as well."

Tesla said in a filing the decision was part of its broad investment policy as a company and was aimed at diversifying and maximizing its returns on cash. The report said it ended 2020 with $19.38 billion in cash and cash equivalents.

"He's now putting his money (shareholders') where his mouth is," Markets.com analyst Neil Wilson said.

"But given his recent comments – and adding #Bitcoin to his Twitter bio on January 29th – it also raises a real question about possible market manipulation."

Central banks remain skeptical of digital currencies, but analysts say the more real-world uses appear for bitcoin, the more attractive it will prove as a long-term store of value.

Tesla is the latest corporate to add bitcoin to its treasury following similar moves by Square Inc, the payments company led by Twitter Inc chief Jack Dorsey and U.S. software firm MicroStrategy Inc.

In December, Musk had asked about the possibility of converting "large transactions" of Tesla balance sheet into bitcoin on Twitter. Michael Saylor, Microstrategy's CEO had suggested the billionaire make the move.

PayPal said in October that it would allow customers to buy, sell and hold bitcoin and other virtual coins using its online wallets. It remains to be seen whether bitcoin will see greater adoption as a form of payment, something that it has traditionally struggled to achieve.

"I think a lot of institutions and corporates who thought the Saylor move was curious might actually see the upside in taking a small hedge on bitcoin for better returns than any other fiat yield in 2021 and follow," said Maya Zehavi, a blockchain consultant.

"If this becomes a trend in corporate treasuries the downside of staying on the sidelines will only become costlier over time."

Reuters content was included in this report.

Sign in to post

Please sign in to leave a comment.

Continue