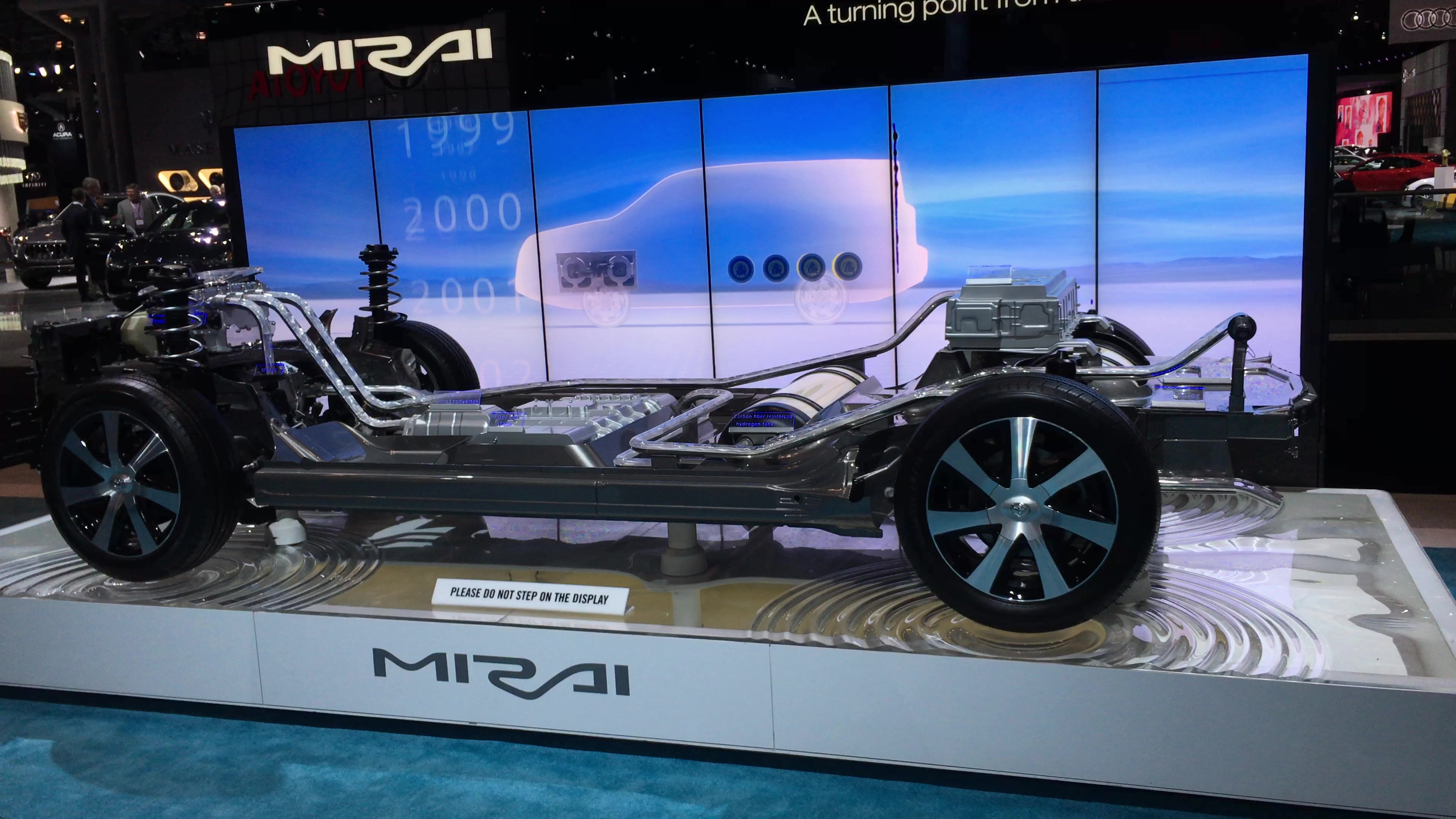

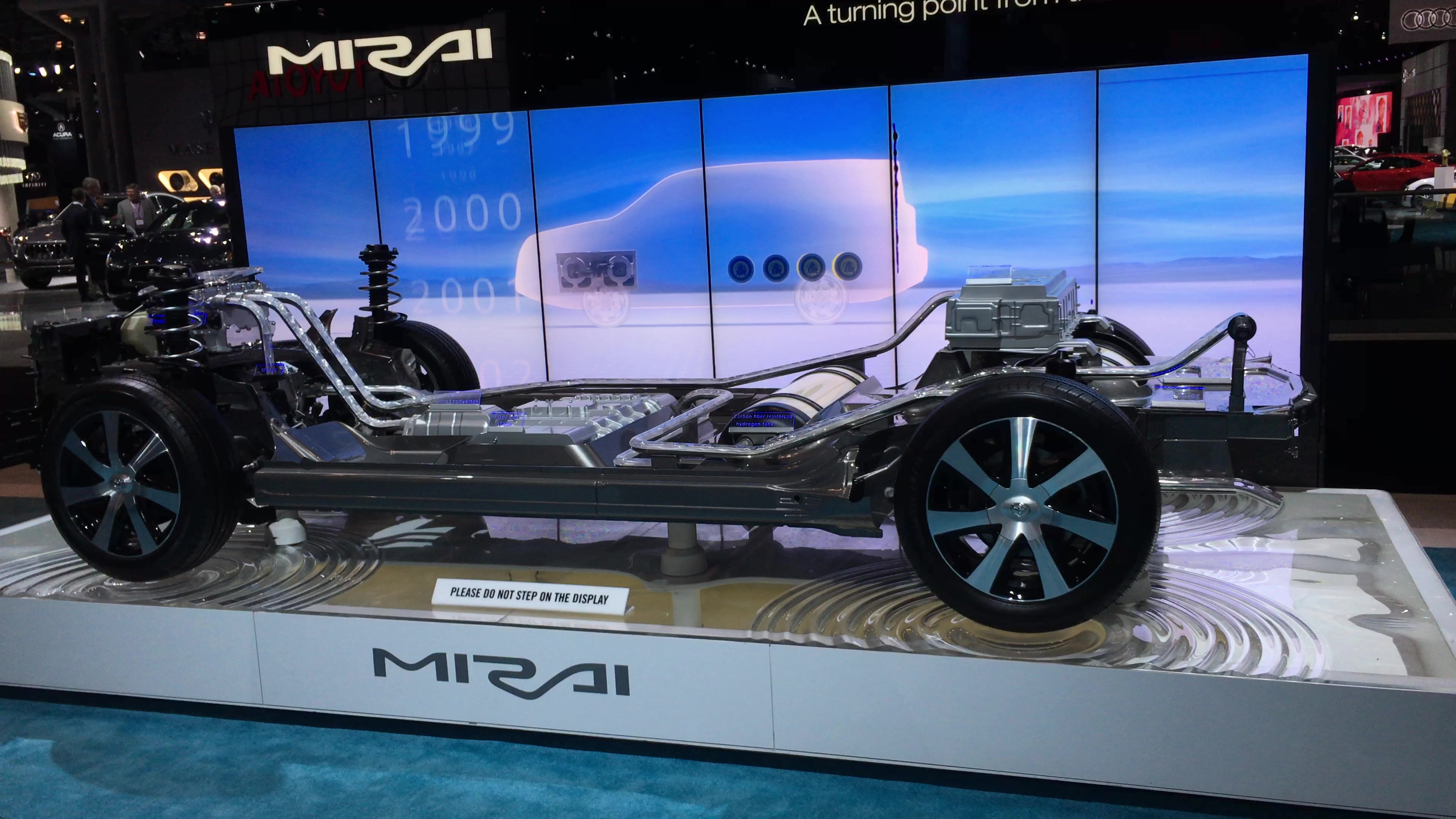

Hydrogen fuel cell technology can be considered a "best of both worlds" approach to cleaner mobility because of its shorter, conventional-vehicle-like fill-up times, full-tank range, and zero-emissions proposition. The problem is that both the vehicles and hydrogen distribution systems are costly to produce, so the sector has so far been very narrow. And with just three hydrogen fuel cell vehicles in production – Toyota Mirai, Honda Clarity, and Hyundai ix35/Tucson – that market is likely to stay in the niche realm for at least the next dozen years or so.

IHS Automotive projects that annual fuel-cell vehicle sales will reach more than 70,000 a year by 2027, and while that marks a substantial increase from today, it still will represent less than one in a thousand new vehicles produced. With European automakers jumping into the sector, more than 14 new hydrogen fuel cell models will be introduced during the next dozen years or so. That said, with hydrogen fuel pumps costing $3 million a pop, infrastructure will be a challenge, as there are only about 100 publicly accessible hydrogen refueling stations in the world in a decade.

As it is, fuel cell vehicles aren't real cheap, either. The Mirai costs $57,500 and leases for $499 a month, while the Hyundai and Honda models are right around those figures as well (although the hydrogen has been free, so far).

Additionally, two things need to happen in order to make any sort of hydrogen fuel cell expansion more earth-friendly, says IHS Automotive: more hydrogen production needs to be derived from renewable sources, as opposed to "brown hydrogen" from natural gas, liquid hydrocarbons, and coal; and technology must improve so that less platinum is required for the catalysts in fuel cells. Automakers and others are working on these issues, but IHS doesn't seem to think a lot of progress will be made for a long while still. Take a look below and here for more information on the IHS Automotive report.

Related Video:

IHS Automotive projects that annual fuel-cell vehicle sales will reach more than 70,000 a year by 2027, and while that marks a substantial increase from today, it still will represent less than one in a thousand new vehicles produced. With European automakers jumping into the sector, more than 14 new hydrogen fuel cell models will be introduced during the next dozen years or so. That said, with hydrogen fuel pumps costing $3 million a pop, infrastructure will be a challenge, as there are only about 100 publicly accessible hydrogen refueling stations in the world in a decade.

As it is, fuel cell vehicles aren't real cheap, either. The Mirai costs $57,500 and leases for $499 a month, while the Hyundai and Honda models are right around those figures as well (although the hydrogen has been free, so far).

Additionally, two things need to happen in order to make any sort of hydrogen fuel cell expansion more earth-friendly, says IHS Automotive: more hydrogen production needs to be derived from renewable sources, as opposed to "brown hydrogen" from natural gas, liquid hydrocarbons, and coal; and technology must improve so that less platinum is required for the catalysts in fuel cells. Automakers and others are working on these issues, but IHS doesn't seem to think a lot of progress will be made for a long while still. Take a look below and here for more information on the IHS Automotive report.

Related Video:

Global Hydrogen Fuel Cell Electric Vehicle Market Buoyed as OEMs Will Launch 17 Vehicle Models by 2027, IHS Says

"We are now in the third wave of FCEVs from OEMs and more Hydrogen Refueling Infrastructure is beginning to be rolled out"

SOUTHFIELD, Mich. (May 4, 2016) – Production of Global Hydrogen Fuel Cell Electric Vehicles (FCEVs) is expected to reach more than 70,000 vehicles annually by 2027, as more automotive OEMs bring FCEVs to market, according to a new FCEV report from IHS Automotive, part of IHS, Inc. (NYSE: IHS). The report takes a holistic view on FCEV production, components and hydrogen and infrastructure markets.

"Recently there has been an increasing focus on battery electric vehicles and battery technology, but FCEVs could also play a key role in zero-carbon mobility," said Ben Scott, senior analyst with IHS Automotive. "We are now in the third wave of FCEVs from OEMs and more Hydrogen Refueling Infrastructure is beginning to be rolled out," he said. "This could be a 'now or never' situation for FCEVs in mass market mobility."

OEM Offerings

There are only three FCEVs currently available for consumers to purchase/lease; Toyota Mirai, Hyundai ix35/Tucson and the Honda Clarity, all of which are only available in select markets. However, during the next 11 years, the number of available FCEV models is expected to jump to 17, as more OEMs add FCEVs to their product portfolios, IHS says. As expected, in the near-term, most FCEV production is expected to be in Japan and Korea, but by 2021, European FCEV production will take the lead globally. This indicates a shift in regional momentum for FCEVs as OEMs look to meet emissions targets. However, by 2027, FCEV will only represent less than 0.1 percent of all vehicles produced, according to IHS Automotive forecasts.

Many comparisons are made between Battery Electric Vehicles (BEVs) and FCEVs. Current generation FCEVs share similar benefits to conventional cars; short refueling times and long range. Most BEVs on the road today do not have these advantages. "Refueling habits with an FCEV will be very similar to that of a conventional car. This will definitely help with customer acceptance of FCEVs," Scott said.

Battery technology is improving each year, with $/kWh decreasing, while energy density increases. Although hydrogen has the advantage in terms of refueling times and range, battery technology is catching up. Until this happens, the FCEV market has a window of opportunity to establish itself as a serious contender in long term zero-carbon mobility. IHS analysts say. If the FCEV market has not reached this stage in the next 20-25 years (i.e., moved past the early adopter phase), then FCEVs will remain only in niche applications.

Hydrogen Refueling Infrastructure

While FCEVs have the advantage of short refueling times and long range, there is still the problem of hydrogen refueling infrastructure. To date, there are approximately 100-plus public hydrogen refueling stations globally. OEMs are currently defining the early adopter markets, and this is where hydrogen refueling stations will be deployed. Hydrogen refueling stations are typically quite large and oftentimes need dedicated sites. EV charging stations are relatively inexpensive, whereas a hydrogen refueling station can cost more than $3 million (USD).

There is already a very well established hydrogen market, but 96 percent of all hydrogen produced is derived from fossil fuels (brown hydrogen), the feedstocks being natural gas, liquid hydrocarbons and coal. For truly sustainable, zero-carbon mobility, the hydrogen used to refuel FCEVs needs to come from renewable sources (green hydrogen). This can be achieved using an electrolyzer and electricity from a renewable source (solar PV, wind turbine etc.). However, the cost of green hydrogen will come at a premium compared to hydrogen from an existing plant, like a steam methane reformer. "There is no market today to justify that premium and that market needs to be created to encourage investment in upstream hydrogen production capability. There is currently a trade-off between hydrogen carbon footprint and cost," Scott said.

Platinum use

Platinum is used as a catalyst in fuel cells. Therefore, if FCEVs do become a key player in long-term zero carbon mobility, then demand for platinum will increase. "In current generation FCEVs, the amount of platinum used is five to six times that of a diesel catalytic converter, but the aim is to reduce the amount of platinum used when fully commercialized and there is R&D into non-noble metal catalysts," Scott said. However, FCEVs could still offer a good opportunity for platinum producers especially considering the pessimist sentiment around long-term demand prospects of diesel engine vehicles and therefore platinum automotive catalyst demand.

The full report is available for purchase here. For additional research and analysis on the electric vehicle and hybrid markets, visit the IHS Automotive Hybrid-EV Portal.

####

About IHS Automotive (www.ihs.com/automotive)

IHS Automotive, part of IHS Inc. (NYSE: IHS), offers clients the most comprehensive content and deepest expertise and insight on the automotive industry available anywhere in the world today. With the 2013 addition of Polk, IHS Automotive now provides expertise and predictive insight across the entire automotive value chain from product inception—across design and production—to the sales and marketing efforts used to maximize potential in the marketplace. No other source provides a more complete picture of the global automotive industry. IHS is the leading source of information, insight and analytics in critical areas that shape today's business landscape. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs nearly 9,000 people in 33 countries around the world.

"We are now in the third wave of FCEVs from OEMs and more Hydrogen Refueling Infrastructure is beginning to be rolled out"

SOUTHFIELD, Mich. (May 4, 2016) – Production of Global Hydrogen Fuel Cell Electric Vehicles (FCEVs) is expected to reach more than 70,000 vehicles annually by 2027, as more automotive OEMs bring FCEVs to market, according to a new FCEV report from IHS Automotive, part of IHS, Inc. (NYSE: IHS). The report takes a holistic view on FCEV production, components and hydrogen and infrastructure markets.

"Recently there has been an increasing focus on battery electric vehicles and battery technology, but FCEVs could also play a key role in zero-carbon mobility," said Ben Scott, senior analyst with IHS Automotive. "We are now in the third wave of FCEVs from OEMs and more Hydrogen Refueling Infrastructure is beginning to be rolled out," he said. "This could be a 'now or never' situation for FCEVs in mass market mobility."

OEM Offerings

There are only three FCEVs currently available for consumers to purchase/lease; Toyota Mirai, Hyundai ix35/Tucson and the Honda Clarity, all of which are only available in select markets. However, during the next 11 years, the number of available FCEV models is expected to jump to 17, as more OEMs add FCEVs to their product portfolios, IHS says. As expected, in the near-term, most FCEV production is expected to be in Japan and Korea, but by 2021, European FCEV production will take the lead globally. This indicates a shift in regional momentum for FCEVs as OEMs look to meet emissions targets. However, by 2027, FCEV will only represent less than 0.1 percent of all vehicles produced, according to IHS Automotive forecasts.

Many comparisons are made between Battery Electric Vehicles (BEVs) and FCEVs. Current generation FCEVs share similar benefits to conventional cars; short refueling times and long range. Most BEVs on the road today do not have these advantages. "Refueling habits with an FCEV will be very similar to that of a conventional car. This will definitely help with customer acceptance of FCEVs," Scott said.

Battery technology is improving each year, with $/kWh decreasing, while energy density increases. Although hydrogen has the advantage in terms of refueling times and range, battery technology is catching up. Until this happens, the FCEV market has a window of opportunity to establish itself as a serious contender in long term zero-carbon mobility. IHS analysts say. If the FCEV market has not reached this stage in the next 20-25 years (i.e., moved past the early adopter phase), then FCEVs will remain only in niche applications.

Hydrogen Refueling Infrastructure

While FCEVs have the advantage of short refueling times and long range, there is still the problem of hydrogen refueling infrastructure. To date, there are approximately 100-plus public hydrogen refueling stations globally. OEMs are currently defining the early adopter markets, and this is where hydrogen refueling stations will be deployed. Hydrogen refueling stations are typically quite large and oftentimes need dedicated sites. EV charging stations are relatively inexpensive, whereas a hydrogen refueling station can cost more than $3 million (USD).

There is already a very well established hydrogen market, but 96 percent of all hydrogen produced is derived from fossil fuels (brown hydrogen), the feedstocks being natural gas, liquid hydrocarbons and coal. For truly sustainable, zero-carbon mobility, the hydrogen used to refuel FCEVs needs to come from renewable sources (green hydrogen). This can be achieved using an electrolyzer and electricity from a renewable source (solar PV, wind turbine etc.). However, the cost of green hydrogen will come at a premium compared to hydrogen from an existing plant, like a steam methane reformer. "There is no market today to justify that premium and that market needs to be created to encourage investment in upstream hydrogen production capability. There is currently a trade-off between hydrogen carbon footprint and cost," Scott said.

Platinum use

Platinum is used as a catalyst in fuel cells. Therefore, if FCEVs do become a key player in long-term zero carbon mobility, then demand for platinum will increase. "In current generation FCEVs, the amount of platinum used is five to six times that of a diesel catalytic converter, but the aim is to reduce the amount of platinum used when fully commercialized and there is R&D into non-noble metal catalysts," Scott said. However, FCEVs could still offer a good opportunity for platinum producers especially considering the pessimist sentiment around long-term demand prospects of diesel engine vehicles and therefore platinum automotive catalyst demand.

The full report is available for purchase here. For additional research and analysis on the electric vehicle and hybrid markets, visit the IHS Automotive Hybrid-EV Portal.

####

About IHS Automotive (www.ihs.com/automotive)

IHS Automotive, part of IHS Inc. (NYSE: IHS), offers clients the most comprehensive content and deepest expertise and insight on the automotive industry available anywhere in the world today. With the 2013 addition of Polk, IHS Automotive now provides expertise and predictive insight across the entire automotive value chain from product inception—across design and production—to the sales and marketing efforts used to maximize potential in the marketplace. No other source provides a more complete picture of the global automotive industry. IHS is the leading source of information, insight and analytics in critical areas that shape today's business landscape. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs nearly 9,000 people in 33 countries around the world.

Sign in to post

Please sign in to leave a comment.

Continue