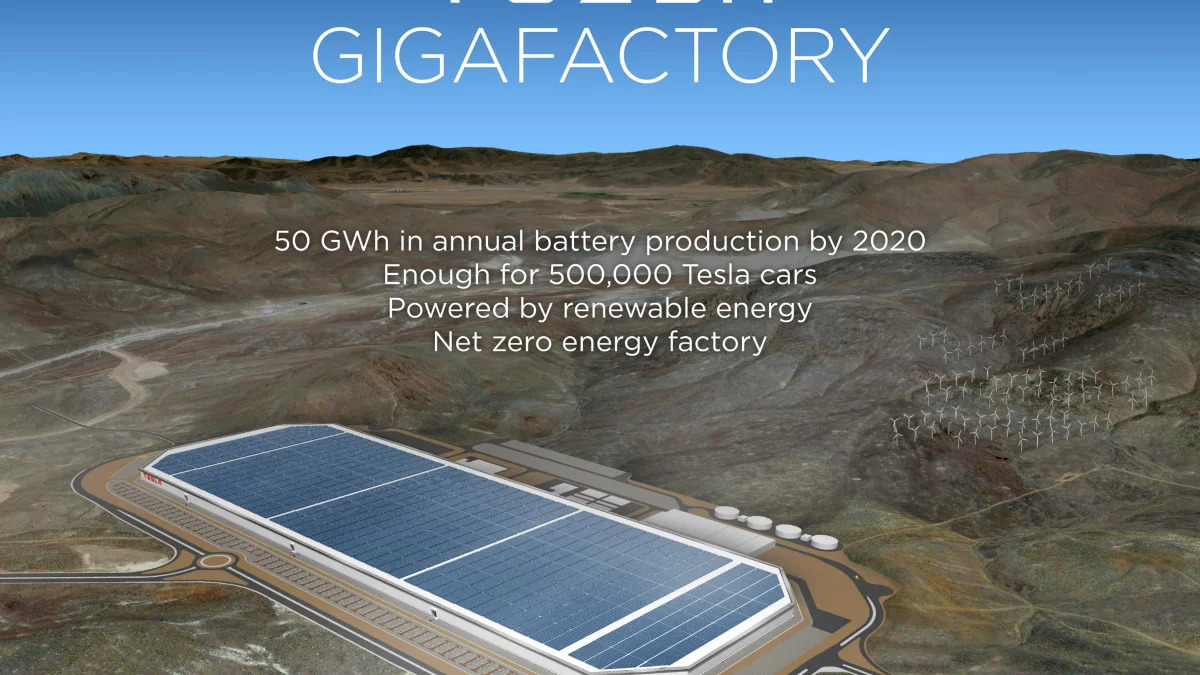

We made our gigafactory predictions the other day and, it turns out, we were pretty much on target. Today, Tesla Motors released the first official details on its upcoming massive battery plant and we see sun and wind power feeding energy into a plant that will employ around 6,500 people and make enough packs for around a half-million Tesla EVs a year. You read that right. Tesla is getting ready to produce 500,000 EVs a year, and that's already in 2020. Tesla hopes to start selling a lower-cost EV, the Model E, in about three years.

The finalists for where the Gigafactory will be built include the Southwestern states of Nevada, Arizona, New Mexico and Texas (our money is on Nevada). We were a little low on the estimated battery output. Instead of being able to make 30 Gigawatt-hours of batteries per year, Tesla is saying that it will have enough capacity to produce 35 GWh of cells and 50 GWh of packs a year. We think that's for both EVs and stationary applications and have reached out to Tesla for confirmation on this point. You can see the details for yourself here and in our gallery below.

Through 2020, Tesla will directly invest around $2 billion in the plant and its partners will pony up another $2-3 billion for a total cost of $4-5 billion. That's a lot of cash, but Tesla says that it will make buying an EV much, much cheaper. The company is saying that, once the plant is up and running for the first year, the per-kWh cost of a Tesla battery pack will be lowered by "more than 30 percent." Maybe that Model E isn't such a pipe dream after all.

Also today, Tesla announced a new convertible notes offering worth $1.6 billion. Details are available in the press release below.

The finalists for where the Gigafactory will be built include the Southwestern states of Nevada, Arizona, New Mexico and Texas (our money is on Nevada). We were a little low on the estimated battery output. Instead of being able to make 30 Gigawatt-hours of batteries per year, Tesla is saying that it will have enough capacity to produce 35 GWh of cells and 50 GWh of packs a year. We think that's for both EVs and stationary applications and have reached out to Tesla for confirmation on this point. You can see the details for yourself here and in our gallery below.

Through 2020, Tesla will directly invest around $2 billion in the plant and its partners will pony up another $2-3 billion for a total cost of $4-5 billion. That's a lot of cash, but Tesla says that it will make buying an EV much, much cheaper. The company is saying that, once the plant is up and running for the first year, the per-kWh cost of a Tesla battery pack will be lowered by "more than 30 percent." Maybe that Model E isn't such a pipe dream after all.

Also today, Tesla announced a new convertible notes offering worth $1.6 billion. Details are available in the press release below.

Tesla Announces $1.6 Billion Convertible Notes Offering

Wednesday, February 26, 2014

PALO ALTO, Calif., February 26, 2014 – Tesla announced today an offering of $1.6 billion aggregate principal amount of convertible senior notes in an underwritten registered public offering. Of the total offering, Tesla will offer $800 million aggregate principal amount of convertible senior notes due 2019 and $800 million aggregate principal amount of convertible senior notes due 2021. In addition, Tesla intends to grant the underwriters a 30-day option to purchase up to an additional $120 million in aggregate principal amount of convertible senior notes due 2019 and an additional $120 million in aggregate principal amount of convertible senior notes due 2021, for a total potential offering size of up to $1.84 billion.

Tesla intends to use the net proceeds from the offering to accelerate the growth of its business in the U.S. and internationally, for the development and production of its "Gen III" mass market vehicle, the development of the Tesla Gigafactory and other general corporate purposes.

The convertible senior notes due 2019 will be convertible into cash, shares of Tesla's common stock, or a combination thereof, at Tesla's election. The convertible senior notes due 2021 will be convertible into cash and, if applicable, shares of Tesla's common stock (subject to Tesla's right to deliver cash in lieu of such shares of common stock). The interest rate, conversion rate and other terms of the notes are to be determined.

In connection with the offering of the notes, Tesla intends to enter into convertible note hedge transactions and warrant transactions, which are generally expected to prevent dilution up to approximately 100% over the common stock price at the time of pricing of the notes due 2019 and 120% over the common stock price at the time of pricing of the notes due 2021. Tesla intends to use a portion of the proceeds from the offering to pay the net cost of the convertible note hedge transactions. In connection with establishing their initial hedge of the convertible note hedge and warrant transactions, the hedge counterparties or their affiliates expect to enter into various derivative transactions with respect to our common stock concurrently with or shortly after the pricing of the notes, including with certain investors in the notes.

Goldman, Sachs & Co., Morgan Stanley, J.P. Morgan and Deutsche Bank Securities are acting as joint book-running managers for the offering.

An effective registration statement relating to the securities was filed with the Securities and Exchange Commission on May 15, 2013. The offering of these securities will be made only by means of a prospectus supplement and the accompanying prospectus. Copies of the preliminary prospectus supplement and the accompanying prospectus may be obtained from Goldman, Sachs & Co., via telephone: (866) 471-2526; facsimile: (212) 902-9316; email: prospectus-ny@ny.email.gs.com; or standard mail at Goldman, Sachs & Co., Attn: Prospectus Department, 200 West Street, New York, NY 10282-2198; from Morgan Stanley & Co. LLC, Attn: Prospectus Department, 180 Varick Street, Second Floor, New York, NY 10014, or by telephone at (866) 718-1649 or email: prospectus@morganstanley.com; from J.P. Morgan Securities LLC, via telephone: (866) 803-9204; or standard mail at c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717; or from Deutsche Bank Securities Inc., via telephone: (800) 503-4611; email: prospectus.cpdg@db.com; or standard mail at Attn: Prospectus Group, 60 Wall Street, New York, NY 10005.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. The securities being offered have not been approved or disapproved by any regulatory authority, nor has any such authority passed upon the accuracy or adequacy of the registration statement, the prospectus contained therein or the prospectus supplement.

Forward-Looking Statement

Certain statements in this press release, including statements regarding the proposed public offering of convertible notes, and the convertible note hedge and warrant transactions, are "forward-looking statements" that are subject to risks and uncertainties. These forward-looking statements are based on management's current expectations, and as a result of certain risks and uncertainties, actual events or results may differ materially from those contained in the forward-looking statements. Please refer to the registration statement on Form S-3 on file with the SEC and the prospectus and prospectus supplement included or incorporated by reference therein, as well as the other documents Tesla files on a consolidated basis from time to time with the SEC, specifically Tesla's most recent Form 10-K. These documents contain and identify important factors that could cause the actual results for Tesla on a consolidated basis to differ materially from those contained in Tesla's forward-looking statements. Tesla disclaims any obligation to update information contained in these forward-looking statements.

Wednesday, February 26, 2014

PALO ALTO, Calif., February 26, 2014 – Tesla announced today an offering of $1.6 billion aggregate principal amount of convertible senior notes in an underwritten registered public offering. Of the total offering, Tesla will offer $800 million aggregate principal amount of convertible senior notes due 2019 and $800 million aggregate principal amount of convertible senior notes due 2021. In addition, Tesla intends to grant the underwriters a 30-day option to purchase up to an additional $120 million in aggregate principal amount of convertible senior notes due 2019 and an additional $120 million in aggregate principal amount of convertible senior notes due 2021, for a total potential offering size of up to $1.84 billion.

Tesla intends to use the net proceeds from the offering to accelerate the growth of its business in the U.S. and internationally, for the development and production of its "Gen III" mass market vehicle, the development of the Tesla Gigafactory and other general corporate purposes.

The convertible senior notes due 2019 will be convertible into cash, shares of Tesla's common stock, or a combination thereof, at Tesla's election. The convertible senior notes due 2021 will be convertible into cash and, if applicable, shares of Tesla's common stock (subject to Tesla's right to deliver cash in lieu of such shares of common stock). The interest rate, conversion rate and other terms of the notes are to be determined.

In connection with the offering of the notes, Tesla intends to enter into convertible note hedge transactions and warrant transactions, which are generally expected to prevent dilution up to approximately 100% over the common stock price at the time of pricing of the notes due 2019 and 120% over the common stock price at the time of pricing of the notes due 2021. Tesla intends to use a portion of the proceeds from the offering to pay the net cost of the convertible note hedge transactions. In connection with establishing their initial hedge of the convertible note hedge and warrant transactions, the hedge counterparties or their affiliates expect to enter into various derivative transactions with respect to our common stock concurrently with or shortly after the pricing of the notes, including with certain investors in the notes.

Goldman, Sachs & Co., Morgan Stanley, J.P. Morgan and Deutsche Bank Securities are acting as joint book-running managers for the offering.

An effective registration statement relating to the securities was filed with the Securities and Exchange Commission on May 15, 2013. The offering of these securities will be made only by means of a prospectus supplement and the accompanying prospectus. Copies of the preliminary prospectus supplement and the accompanying prospectus may be obtained from Goldman, Sachs & Co., via telephone: (866) 471-2526; facsimile: (212) 902-9316; email: prospectus-ny@ny.email.gs.com; or standard mail at Goldman, Sachs & Co., Attn: Prospectus Department, 200 West Street, New York, NY 10282-2198; from Morgan Stanley & Co. LLC, Attn: Prospectus Department, 180 Varick Street, Second Floor, New York, NY 10014, or by telephone at (866) 718-1649 or email: prospectus@morganstanley.com; from J.P. Morgan Securities LLC, via telephone: (866) 803-9204; or standard mail at c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717; or from Deutsche Bank Securities Inc., via telephone: (800) 503-4611; email: prospectus.cpdg@db.com; or standard mail at Attn: Prospectus Group, 60 Wall Street, New York, NY 10005.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. The securities being offered have not been approved or disapproved by any regulatory authority, nor has any such authority passed upon the accuracy or adequacy of the registration statement, the prospectus contained therein or the prospectus supplement.

Forward-Looking Statement

Certain statements in this press release, including statements regarding the proposed public offering of convertible notes, and the convertible note hedge and warrant transactions, are "forward-looking statements" that are subject to risks and uncertainties. These forward-looking statements are based on management's current expectations, and as a result of certain risks and uncertainties, actual events or results may differ materially from those contained in the forward-looking statements. Please refer to the registration statement on Form S-3 on file with the SEC and the prospectus and prospectus supplement included or incorporated by reference therein, as well as the other documents Tesla files on a consolidated basis from time to time with the SEC, specifically Tesla's most recent Form 10-K. These documents contain and identify important factors that could cause the actual results for Tesla on a consolidated basis to differ materially from those contained in Tesla's forward-looking statements. Tesla disclaims any obligation to update information contained in these forward-looking statements.

Sign in to post

Please sign in to leave a comment.

Continue