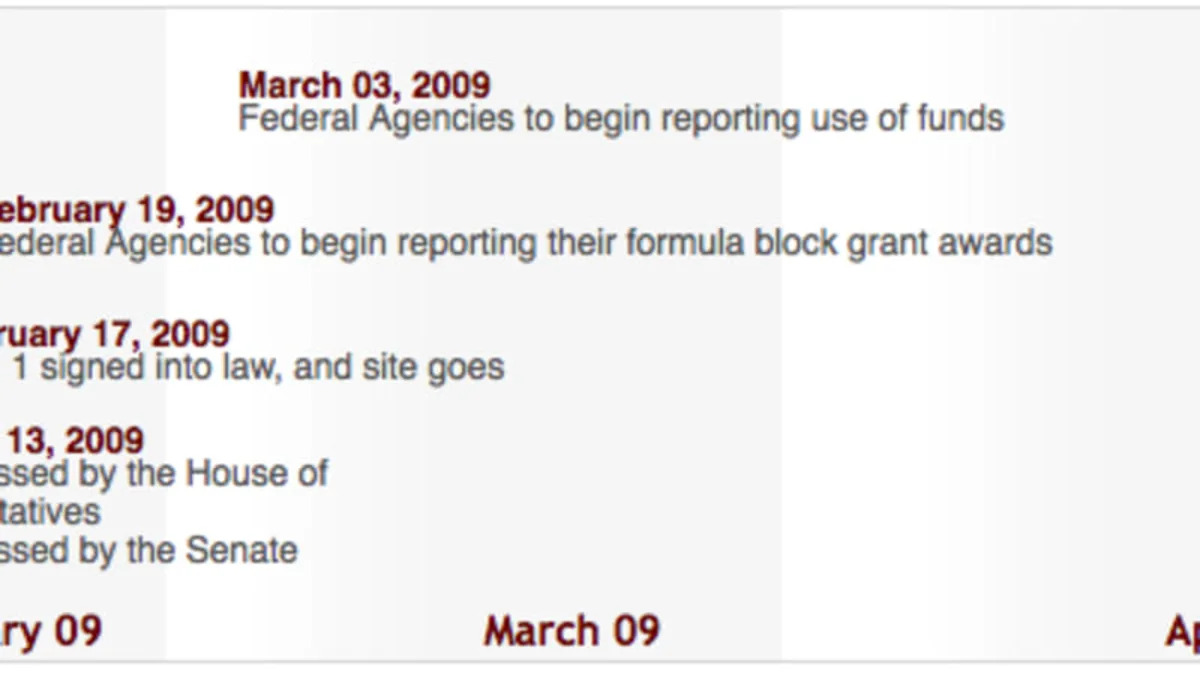

Click above for an interactive timeline

As we noted over the weekend, the Stimulus Bill that moved through Congress contains a lot of help for plug-in vehicles. As you might expect, the advocacy group Plug In America is quite pleased that President Obama signed the bill today (see full statement after the jump). While there is PHEV love in the bill - including $2 billion for advanced battery technologies - hard-hit PHEV-hopeful cities like Flint, Michigan don't necessarily see a lot of help now that the Chevy Volt's future in the city is uncertain. In fact, aside from a tax credit worth up $2,500 to for pure electric low-speed vehicles, cleaner vehicles (i.e., hybrids) available on the lot today don't get a lot of help. HybridCars says that plug-in hybrid conversions can qualify for a tax credit of up to 10 percent of the cost of the conversion, if it's done by an authorized firm before the end of 2011. The bill also allows people who earn less than $125,000 individually, or $250,000 jointly, to deduct the sales tax on a new car. Quite a bit there, but is it enough? What's your take?

[Source: WaPo, Plug In America, HybridCars]

PRESS RELEASE:

Plug In America Hails Plug-in Electric Car Aid in Stimulus Bill

Consumers to Benefit from Tax Relief, More Green Jobs

Plug In America hailed the stimulus bill that President Obama signed today, having helped shape plug-in vehicle provisions in the bill through nationwide grassroots activism and legislative advocacy.

"This bill, which invests more than $2 billion in plug-in technology, will put vastly more numbers and kinds of plug-in electric vehicles on the road," said Plug In America legislative director Jay Friedland. "It will help create jobs and spur spending by incentivizing consumers to purchase the cleanest-running vehicles made today and those just around the corner."

As the stimulus bill moved through Congress, Plug In America's supporters sent some 62,000 email messages to their representatives coast to coast. The nonprofit organization urged a significant increase in the number and types of vehicles covered by a plug-in vehicle tax credit. It won expansion of the tax credit from 250,000 vehicles industry wide to 200,000 vehicles per manufacturer, and the inclusion of two- and three-wheeled electric vehicles and plug-in hybrid conversions.

Eight major auto companies have announced the manufacture, with delivery dates, of highway capable all-electric or plug-in hybrid vehicles. Therefore, the historic bill, which has a tax credit of up to $7,500 per vehicle, has the potential to stimulate the sale of up to one-and-a-half million plug-in vehicles.

"The President has called for one million plug-ins by 2015, and while we'd like to reach that number even sooner, this provision will do wonders in helping us to meet Obama's goal," Friedland said. "It also gives the auto companies tremendous incentive to accelerate their delivery."

Plug In America helped shape an amendment by Sen. Maria Cantwell (D-WA) extending a 10% plug-in car tax credit to all-electric motorcycles, three-wheeled enclosed electric vehicles, Neighborhood Electric Vehicles, and plug-in cars that have been converted from gas cars or hybrids such as the Toyota Prius. Some of these vehicles are already for sale and are the most affordable clean vehicles available.

The amendment passed the Senate with broad bipartisan support, 80-16, showing a unified commitment to get plug-ins on the road.

"This bill makes an investment in our future in electric plug-in vehicles by making sure we create the right incentives for investment in this kind of manufacturing," Sen. Cantwell said in her Senate floor speech. "... we are going to create economic opportunity now...create jobs for the future and [get] us off of our foreign dependence on oil."

Plug In America also worked closely with a bipartisan group of senators including Sen. Orrin Hatch (R-UT), and with plug-in hybrid organizations including CalCars.org, and a coalition it created of plug-in vehicle businesses from coast to coast including A123/Hymotion, Aptera, Brammo, Electric Motorsport, Mission Motorcycles, Myers Motors, Persu Mobility, Plug In Conversions Corp., Vectrix, and Zero Motorcycles.

The final bill, which also boosted tax credits for plug-in vehicle infrastructure, modifies a plug-in vehicle tax credit passed into law at the end of the previous congressional session. The credit ranges from $2,500 to $7,500 for vehicles equipped with 4- to 16-kilowatt hours of battery energy. The auto companies that have announced delivery dates are GM, Chrysler, Ford, Toyota, Nissan, Mitsubishi, Hyundai and BMW.

About Plug In America: Plug In America is leading the nation's plug-in vehicle movement. The nonprofit organization works to accelerate the shift to plug-in vehicles powered by clean, affordable, domestic electricity to reduce our nation's dependence on petroleum and improve the global environment. For more information: http://www.pluginamerica.org.

Sign in to post

Please sign in to leave a comment.

Continue