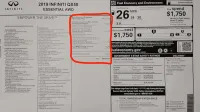

Auto Loan Calculator

Estimated Monthly Payment

- Principal:

- Interest

| 36 month | 3.84% |

| 48 month | 4.17% |

| 60 month | 4.25% |

| 72 month | 4.94% |

| 36 month | 4.35% |

| 48 month | 4.54% |

| 60 month | 4.72% |

Estimated Loan Amount

| 36 month | 3.84% |

| 48 month | 4.17% |

| 60 month | 4.25% |

| 72 month | 4.94% |

| 36 month | 4.35% |

| 48 month | 4.54% |

| 60 month | 4.72% |

Financing News & Advice

Chinese EV maker Nio starts battery leasing service to make electric cars cheaper

Chinese electric vehicle (EV) maker Nio Inc has launched a battery leasing service that will allow drivers to buy an EV without owning the battery pack - one of the most expensive EV components - thereby lowering the starting price of its cars. The cheapest Nio car after subsidies is now an ES6 sport-utility vehicle (SUV) priced 273,600 yuan ($39,553) without ownership of the battery pack, versus 343,600 yuan including the pack. "We believe with BaaS, more customers of gasoline cars will consi

What is the term of a car loan or lease?

Explaining what a loan and lease are, as well as which might be better for you.

What does 'drive-off cost' mean, and what does it include?

Also known as "total due at signing" or "out the door."

Leasing vs. buying a car: How to decide

To lease or not to lease ... That is the question.

Mercedes-Benz Collection subscription service launches in Nashville, Philadelphia

Here comes Mercedes-Benz jumping into the monthly subscription-service craze, launching its pilot program in Nashville and Philadelphia. It'll be called the Mercedes-Benz Collection.

BMW monthly subscription service: Now we know how much it'll cost

BMW has officially launched its new vehicle subscription service, becoming the latest automaker to embrace the more flexible alternative to traditional leasing. It's called Access by BMW, and it'll offer a selection of vehicles in two tiers via a new mobile app or dedicated website.

Ford to launch online car-shopping service

Ford is launching a new online car-shopping service that will allow users to do things like view local pricing and incentives, apply for financing and schedule test drives all before setting foot inside a showroom. It's the latest tool to help people spend less time at dealerships.