Wondering how much Tesla Motors might be worth on the open market? It would seem the actual figure would depend you who you ask. Based on the assumption that Daimler paid $50 million for nine-percent of Tesla, the Silicon Valley automaker would theoretically be worth $550 million.

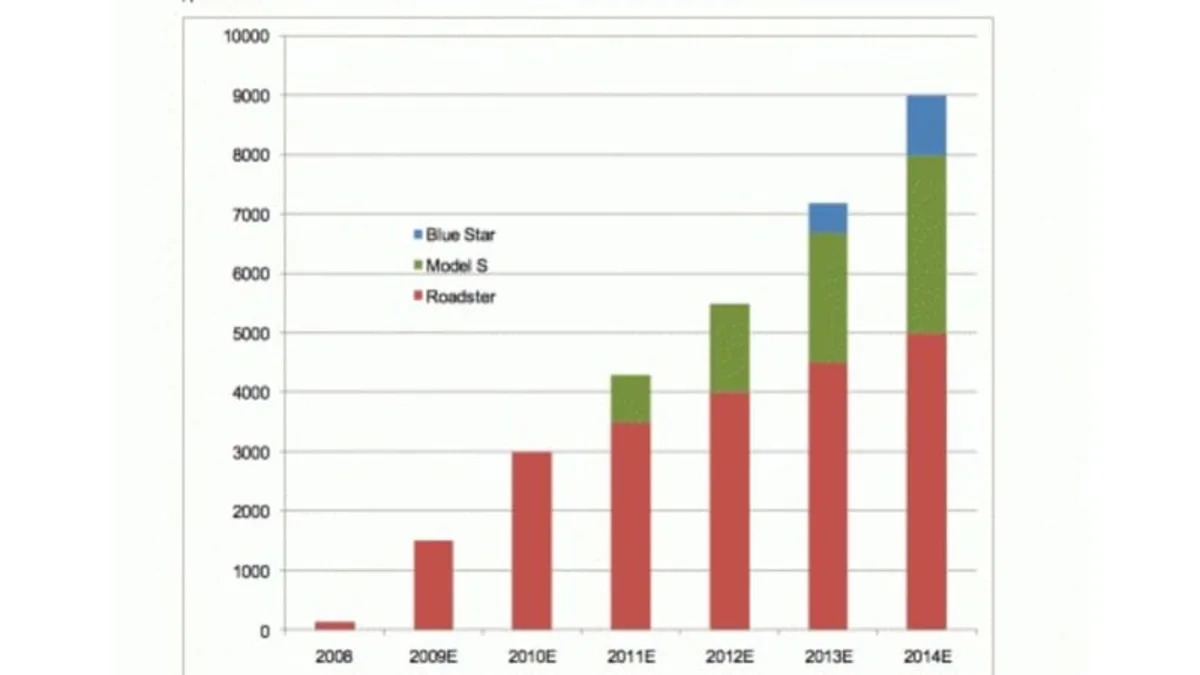

According to SharesPost, a firm that bills itself as a community for private equity transactions and the central hub for private company research and valuation data, Tesla's value is actually much higher: roughly $1 billion. To come up with that figure, SharesPost contracted Next Up Research to create a report that supposedly takes into account current revenue from Roadster sales as well as expected revenue from the Tesla Model S and a future electric vehicle, codenamed Blue Star, which will be smaller and cost less than the S.

Next Up outlines the potential risks in investing in a startup automaker like Tesla, such as a "lack of significant cost or performance advantage" over conventional sports cars, the vast number of expected competitors and possible safety issues with using advanced lithium ion batteries.

Clearly, there are some major assumptions at work here.

According to SharesPost, a firm that bills itself as a community for private equity transactions and the central hub for private company research and valuation data, Tesla's value is actually much higher: roughly $1 billion. To come up with that figure, SharesPost contracted Next Up Research to create a report that supposedly takes into account current revenue from Roadster sales as well as expected revenue from the Tesla Model S and a future electric vehicle, codenamed Blue Star, which will be smaller and cost less than the S.

Next Up outlines the potential risks in investing in a startup automaker like Tesla, such as a "lack of significant cost or performance advantage" over conventional sports cars, the vast number of expected competitors and possible safety issues with using advanced lithium ion batteries.

Clearly, there are some major assumptions at work here.

[Source: Earth2Tech]

Sign in to post

Please sign in to leave a comment.

Continue