Last month the International Energy Agency published its second Net Zero Roadmap report, which describes a way for the global economy to meet the goals of the Paris Agreement. The first edition of the report, in 2021, was a departure for an organization known more for its detailed data than its normative view of the future. This year’s roadmap finds no immediate progress on emissions, but it does offer a “brighter note.” As the authors state in their introduction, “The path to 1.5 degrees C has narrowed, but clean energy growth is keeping it open.”

Behind that growth, or perhaps within it, is the expansion of what the IEA calls “mass manufactured technologies”: solar photovoltaics, electric cars, residential heat pumps and stationary battery storage. These products benefit from “standardization and short lead times,” which means they can be produced by the millions or hundreds of millions, and manufacturers can roll out new and improved versions at a rapid clip.

For instance, between 2015 (when the Paris Agreement was signed) and 2022, solar PV added as much capacity as all of Europe’s installed power generation, and heat pump sales increased to a level “approximately equivalent to the entire residential heating capacity in Russia.”

These milestones are impressive, but even for those steeped in energy data, they are also a bit airless, without reference to something outside energy itself. We know that mass-manufactured clean energy technologies are growing fast – but how does that compare to other sectors and other periods of time?

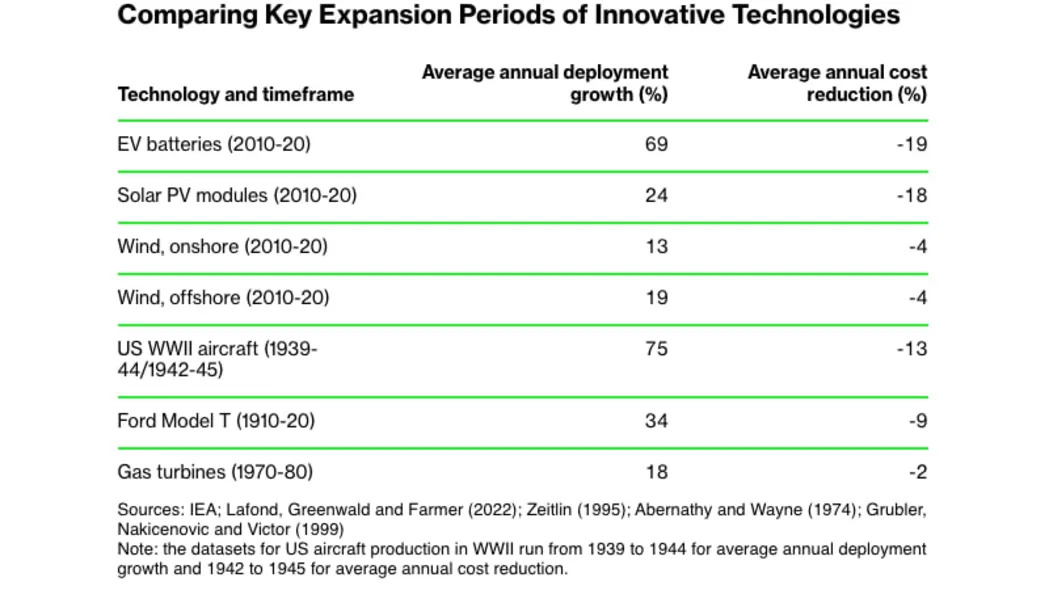

This year, the IEA provides some useful analogies, setting EV batteries, solar modules and wind turbines against three innovative technologies of the past: US aircraft produced during the Second World War, the Ford Model T from 1910 to 1920 and gas turbine generators from 1970 to 1980.

The report compares these groups based on two factors: the average annual increase in deployment for each technology during its key decade, and how much annual costs declined during that same decade. The result is complex, but in an instructive way.

EV batteries, for example, compare favorably to the fastest-growing historical analogue, US aircraft during WWII. Solar modules grew more rapidly from 2010 to 2020 than gas turbines did during the 1970s, but less rapidly than Model T sales expanded a century prior. Onshore wind grew at about the same pace as gas turbines, and offshore wind grew slightly faster.

In terms of cost reduction, though, batteries and solar are clear winners over their historical counterparts. Battery cost reductions in the prior decade were almost 20% per year on average, and solar cost reductions were not far behind. US aircraft costs fell almost 15% a year, slower than solar or batteries, while Model T costs declined by about 10% every year from 1910 to 1920. Wind technologies, again, compare similarly to the old gas turbine market.

The comparison should energize, so to speak, those hoping for a much greater deployment of these mass manufactured technologies. They are already on the path of innovations that substantially changed the way that people moved (and fought) 80 to 100 years ago.

It also poses a challenge to the drive for net zero greenhouse gas emissions — and a warning.

The challenge is continuing to innovate while pushing solar and battery cost reduction and even higher levels of annual deployment. Here, the IEA’s data cutoff actually works in favor of batteries and solar, which from 2020 through this year will have average annual growth rates of 72% and 39%, respectively, according to BloombergNEF’s market outlooks. Wind, however, is anemic by comparison, with a compound growth rate of only 3%, and one year (2022) of lower growth than the year before.

The warning is that “there is much more to be done,” in the IEA’s words. Partly due to the durability of incumbent energy systems — be they automobiles with a life of more than a decade, or a thermal power plant with a lifespan of 30 to 50 years. As the authors write, “The slow pace of the turnover of stock of most types of energy-related equipment means that there is a considerable lag between a technology becoming dominant in new deployments and that technology becoming dominant in the overall operating stock.”

This condition, then, means two things must prevail. One is the inexorable math of increasing installations of the new, which eventually forces incumbent systems into retirement. The second is policy, and a commitment not just to deploy what is needed, but also to retire what is not.

The market and policy can both embrace the logic of mass standardized technologies in their own ways, but ultimately drive toward the same goal.

Sign in to post

Please sign in to leave a comment.

Continue