In a small seaside town in northeast Japan, factory workers are disassembling old batteries from the world’s first mass-market electric cars and preparing them for a second life. Reusing batteries could help the auto industry live up to its promise to make a truly green transition. But it’s time-consuming and, for now, unprofitable.

Early models of Nissan Motor Co.’s all-electric Leaf, which first went on sale almost 13 years ago, have started to reach the end of their life spans. In an effort to make the end of the cars’ lives as green as their operation was, their used batteries are collected at Nissan dealerships in the US and Japan and sent to the factory in Namie, Fukushima, a town devastated in 2011 by a tsunami and a nuclear disaster.

Engineers at the plant, operated by 4R Energy Co. — Nissan’s joint venture with trading house Sumitomo Corp. — spend hours on each battery pack before shipping them out, mostly to be used again in another electric vehicle but sometimes to be repurposed in other devices, such as backup generators.

Collecting and reusing EV batteries keeps them from being discarded in landfills, where they might release toxins, or from being melted and pulled apart for their metals, which can be hazardous when done improperly. It also would reduce the industry’s reliance on the mining of costly rare-earth elements such as lithium and cobalt and cut down on the carbon emissions involved in making EV batteries — the dark side of the green car business.

Moreover, creating a bigger market for used batteries could boost the secondhand market for electric cars as well, by extending their life span and bolstering their resale value, which would hasten their adoption, says Yutaka Horie, the president of 4R Energy. “For EVs to proliferate, it needs to get easier for customers to buy and sell,” Horie said as he gave a tour of the factory that opened in 2018 with local government support. Namie officials have been trying to attract industries to the area after it lost 90% of its population in the evacuations following the Fukushima disaster.

With all the nuclear reactors in the area now decommissioned, officials are seeking to host businesses dealing with renewable energy and other new technologies. Because the project would help fulfill Nissan’s goal to make EVs more sustainable and popular, profitability was never an urgent priority. But 4R hopes that with time, it will become a profitable business on its own.

At first glance, the factory doesn’t look very cutting-edge. Robots and other automation equipment, a common sight at most car factories these days, aren’t noticeable. Instead, most of the work is done manually by its nine, mostly local engineers.

A reused EV battery can cost about half the price of a new one, according to Bloomberg Intelligence analyst Tatsuo Yoshida. He says what sets Nissan apart from other EV makers is that its 4R subsidiary is concentrating on reusing batteries as opposed to recycling them. Reusing entails swapping out deteriorated cells with healthy ones to extend the life of an aged but still-working battery. When recycling a battery, its rare-earth metals and other useful parts are extracted and used to produce something new.

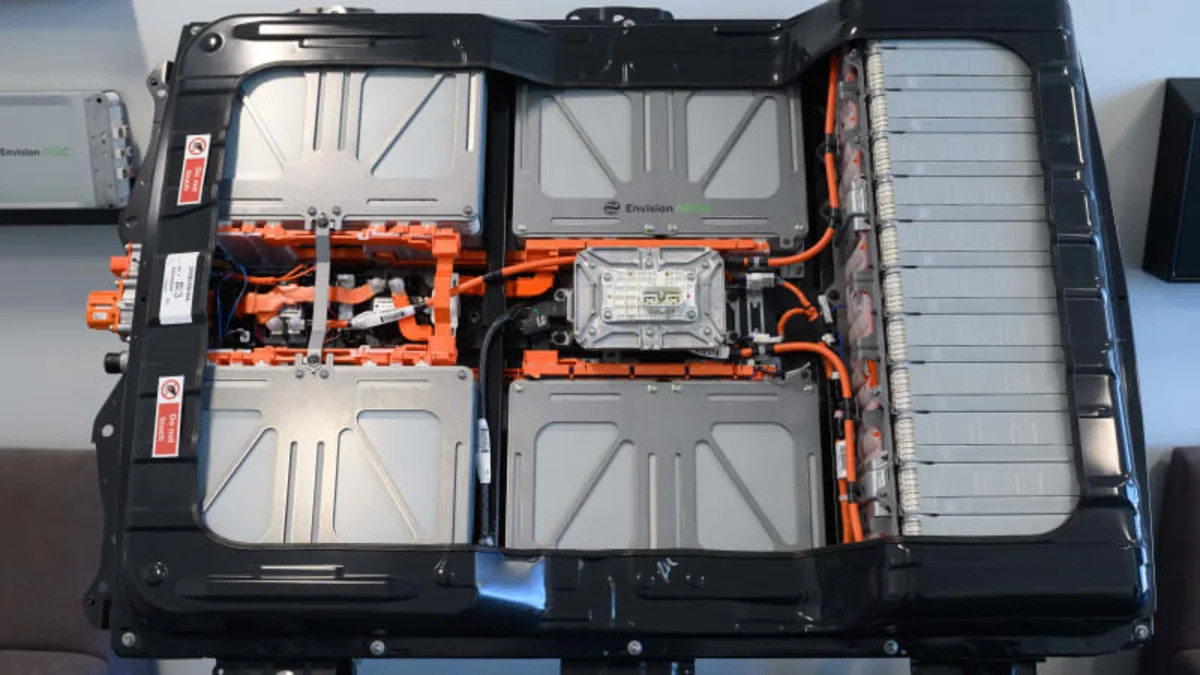

At 4R’s plant in Namie, the process starts by slicing open the battery packs to evaluate their condition. Each pack weighs 300 kilograms (661 pounds) and contains 48 modules, each consisting of two batteries. Once the insides are exposed, they’re plugged into a computer for an initial assessment.

Workers put the packs through a stress test in a sealed room they call the sauna, repeatedly exposing them to extremely high and low temperatures. This provides data on the extent of deterioration and the remaining range in each battery. “This data is everything,” Horie says, motioning toward the sauna.

The data, together with background information on previous owners—which sometimes can include everything from their geographies to driving history—offer insights on how EV batteries degrade over time under different environments, laying the groundwork for future improvements in battery development, he says.

This data-heavy, labor-intensive approach stands in sharp contrast to the recycling method being pursued by automakers such as Tesla and BYD, which break down end-of-life batteries and extract their raw minerals to reuse in completely new batteries. While both methods keep used batteries from ending up in the junkyard, 4R Energy’s extensive testing allows it to salvage more of what remains, meaning there’s less waste. But partly because of the data collection, the process is far more time-consuming.

Battery recycling might be easier to scale up as volume grows, but both recycling and reuse will have a role to play in the future, says BloombergNEF analyst Colin McKerracher. “Battery repurposing is often more time-consuming than recycling, but allows the company to reuse more of the battery materials,” he says.

4R won’t disclose financial details, except to say that it believes greater scale will eventually help it turn a profit. Horie says 4R’s intake has been doubling annually since 2018, and it now receives “thousands of batteries” every year. It also now has storage capacity for 2,000 batteries across three locations in Fukushima. But even with such growth, it’s unclear whether 4R will reach the scale required to turn a profit.

Nissan’s Leaf never quite took off with drivers, selling only 646,000 cars since production began in 2010. Early adopters of environmentally conscious vehicles instead went for hybrids such as the Toyota Prius, and attention in recent years has shifted to Tesla’s sleeker all-electric models.

4R Energy currently only handles old Leaf batteries, but it’s planning to expand its scale by working with other Nissan models including the Sakura, a newer EV popular in Japan. It’s also trying to turn the old batteries into a greater variety of equipment, including power storage units for wind, solar and other renewable energy.

Tooru Futami, who worked at 4R Energy following a career at Nissan developing the Leaf, says the batteries being made today have better range and longer life spans than old ones do, making it hard for used batteries to compete. But he believes this advantage will shrink over time, as long-range batteries join the recycling stream and improvements in battery performance plateau. “Over time, that gap will narrow,” says Futami, now a research fellow at the mobile gaming and e-commerce company DeNa Co. in Tokyo.

The Leaf was the front-runner, but batteries from the first Teslas and other early EVs are also nearing the end of their use, meaning battery recycling and refurbishing is just starting to take off. A recent surge in EV sales means more growth ahead. As many as 77 million EVs could be on the road by 2025, with 229 million by 2030, according to projections by BNEF.

Even in Japan, where EVs accounted for only 1.7% of passenger cars sold last year, the ground is shifting. In February, Nissan said, it will introduce 27 EV models. And Toyota Motor Corp., after years spent focusing on hybrids and gasoline cars, plans to rapidly expand EV production in the next few years.

The Japanese carmakers are still trailing far behind Tesla and others in EVs, despite their early start in the environmentally friendly category. These days, Chinese manufacturers dominate the EV battery supply chain, from mining to assembly, and their recycling capacity is also growing. Analysts say 4R Energy will eventually feel more competitive pressure.

“4R is the front-runner in Japan, but there are dozens like them in China,” says Hideki Kidohshi, a senior specialist in energy and transportation at the Japan Research Institute. He says it’s not realistic to expect financial viability for the company’s efforts right away, anyway. “It’s not about whether this business makes sense now,” he says. “It’s about lowering costs in preparation for future growth.”

Related video:

Sign in to post

Please sign in to leave a comment.

Continue