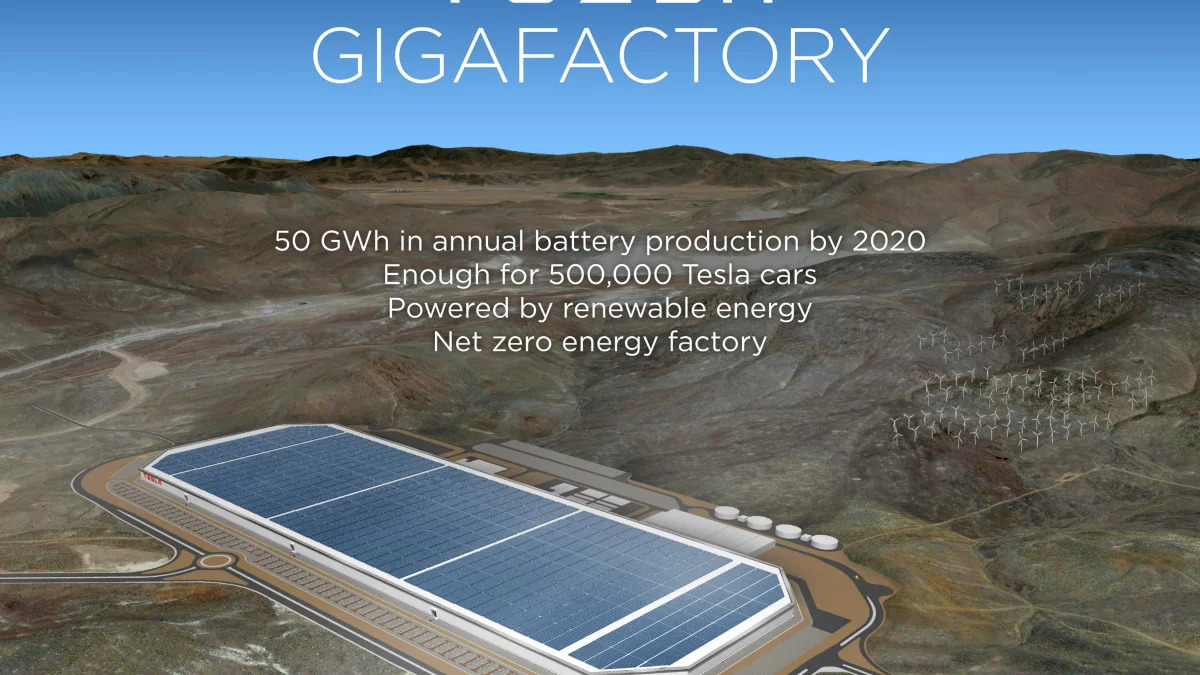

With pro football season about to begin, we thought it appropriate to use a gridiron metaphor: one research firm is estimating that Tesla Motors will outkick its coverage when it comes to the Gigafactory it's planning for the western US, likely Reno, NV. The electric-vehicle maker has said needs the giant battery plant because its annual sales will reach a half-million by the end of the decade. Lux Research is saying the company's EV sales will be closer to about half that.

In fact, Lux says, Tesla will have to sell much of its battery-pack production to either other automakers or to entities such as solar-panel makers for their stationary-battery needs because of overcapacity. And with Panasonic footing the bill for a good chunk of the estimated $4-5 billion pricetag for the plant, the battery maker will also be taking a bit of a bath, at least for the first few years.

Tesla has said its Gigafactory will help it cut battery costs by about 30 percent by 2020, and could have it up and running as soon as 2017. Tesla spokeswoman Alexis Georgeson said in an e-mail to AutoblogGreen that the company wouldn't comment on the Lux Research report (they're probably busy preparing for this afternoon's Nevada announcement) but you can still take a look at Lux Research's short summary of the report called The Tesla-Panasonic Battery Gigafactory: Analysis of Li-ion Cost Trends, EV Price Reduction, and Capacity Utilization below.

In fact, Lux says, Tesla will have to sell much of its battery-pack production to either other automakers or to entities such as solar-panel makers for their stationary-battery needs because of overcapacity. And with Panasonic footing the bill for a good chunk of the estimated $4-5 billion pricetag for the plant, the battery maker will also be taking a bit of a bath, at least for the first few years.

Tesla has said its Gigafactory will help it cut battery costs by about 30 percent by 2020, and could have it up and running as soon as 2017. Tesla spokeswoman Alexis Georgeson said in an e-mail to AutoblogGreen that the company wouldn't comment on the Lux Research report (they're probably busy preparing for this afternoon's Nevada announcement) but you can still take a look at Lux Research's short summary of the report called The Tesla-Panasonic Battery Gigafactory: Analysis of Li-ion Cost Trends, EV Price Reduction, and Capacity Utilization below.

The Tesla-Panasonic Battery Gigafactory: Analysis of Li-ion Cost Trends, EV Price Reduction, and Capacity Utilization

August 13, 2014 | State of the Market Report

Tesla Motors has found initial success in the luxury electric vehicle market, and will look to capitalize on that momentum through aggressive expansion, planning a new 35 GWh lithium-ion (Li-ion) cell production facility. Dubbed the "Gigafactory," it poses a tremendous risk for Tesla and its partner Panasonic, and herein we analyze whether the $5 billion investment is justified by electric vehicle (EV) sales volumes and the interrelated question of breaking through the price floor for Li-ion batteries. We find the Gigafactory will only reduce the Tesla Model 3's cost by $2,800, not enough to truly influence whether this lower-cost EV will be a success or not. Moreover, our analysis indicates that in the likely case of Tesla selling 240,000 EVs in 2020, its partner Panasonic will be risking low margins, and the Gigafactory will be running at significant overcapacity, which other carmakers and stationary applications are unlikely to offset.

August 13, 2014 | State of the Market Report

Tesla Motors has found initial success in the luxury electric vehicle market, and will look to capitalize on that momentum through aggressive expansion, planning a new 35 GWh lithium-ion (Li-ion) cell production facility. Dubbed the "Gigafactory," it poses a tremendous risk for Tesla and its partner Panasonic, and herein we analyze whether the $5 billion investment is justified by electric vehicle (EV) sales volumes and the interrelated question of breaking through the price floor for Li-ion batteries. We find the Gigafactory will only reduce the Tesla Model 3's cost by $2,800, not enough to truly influence whether this lower-cost EV will be a success or not. Moreover, our analysis indicates that in the likely case of Tesla selling 240,000 EVs in 2020, its partner Panasonic will be risking low margins, and the Gigafactory will be running at significant overcapacity, which other carmakers and stationary applications are unlikely to offset.

Sign in to post

Please sign in to leave a comment.

Continue