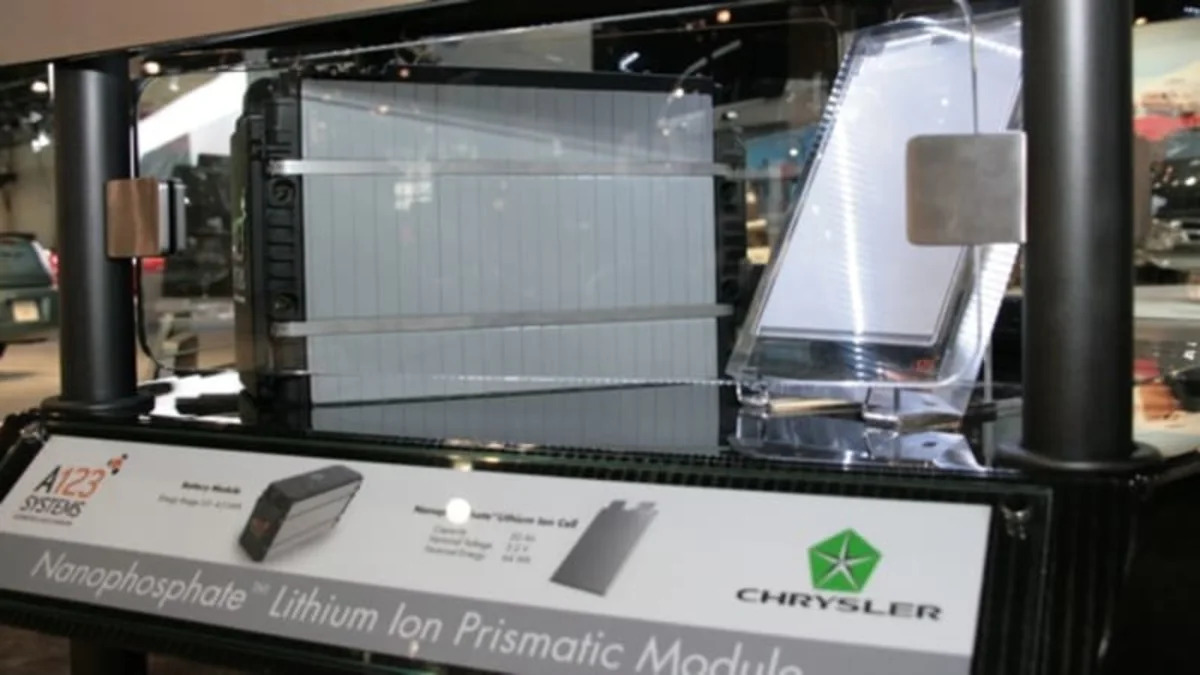

With the closing of the latest round of private fund raising, Massachusetts-based A123 Systems now has an extra $69 million in the bank. General Electric put up $15 million of that amount, bringing its ownership stake in the advanced battery startup to more than 10 percent, the single largest shareholding. This latest funding round comes just one week after Chrysler announced that A123 Systems would be its first primary supplier of lithium ion batteries for electric vehicles. China's SAIC also awarded A123 a development and supply contract.

A123 Systems is still waiting for an answer from federal and state governments on how much, if any, money it will get through the ATVM loan program and stimulus funds for green technology projects. In the meantime, A123 is moving ahead with plans to build a factory in Michigan that will produce automotive lithium ion cells and modules. The A123 press release is after the jump.

[Source: A123 Systems]

PRESS RELEASE:

GE Deepens Relationship with Battery Manufacturer A123Systems Through New Investment and Planned Addition of GE's Technology Head to Board of Directors

A123 Raises $69 Million in New Round of Private Financing

Watertown, MA – April 13, 2009 – A123Systems announced today it has raised $69 million from GE (GE: NYSE) and other investors to accelerate the expansion of its US lithium ion battery manufacturing and smart grid capabilities. The capital will help create new jobs by expanding A123's facilities in Hopkinton, MA, and Novi, MI, as well as build planned new factories in Michigan. The funding will also support A123's efforts to develop applications for the smart grid, such as utility-scale energy storage. Mark Little, GE's Senior Vice President and Director GE Global Research, will join A123's board of directors.

GE Energy Financial Services and GE Capital's Equity unit provided $15 million of the amount raised by A123 in this financing. This is GE's seventh investment in A123, making it the company's largest cash investor and bringing GE's cumulative investment to $70 million – increasing its ownership stake to more than ten percent.

In addition to the private capital, A123 is seeking funds under federal and state stimulus and other programs to ramp up its production capabilities in Michigan. The company's planned production facilities would be capable of supplying battery systems for five million hybrid electric vehicles or a half-million plug-in electric vehicles per year by 2013.

"We've accelerated our plans to expand our US manufacturing. We do not believe our country can afford to wait to develop advanced batteries," said David Vieau, A123Systems' President and Chief Executive Officer. "With this financing, we will begin an expansion that we expect to accelerate upon receipt of government funds. This expansion would create jobs and enable innovation."

"A123 has broken through many technical and engineering barriers to advance lithium ion batteries to commercial applications," said GE Chairman of the Board and CEO Jeff Immelt. "As a company also focused on technology innovation, GE is excited to expand our relationship with this close and long-time partner. GE's capital, resources and technology expertise will help A123 scale up faster and more efficiently."

The manufacturing plants are expected to produce battery cells and systems to meet the needs of A123's broad automotive customer portfolio, which includes several vehicle manufacturers and 19 vehicle models -- ranging from hybrid electric vehicles to electric vehicles. A123 was recently awarded battery development and supply contracts for Chrysler's first generation electric vehicle line-up and the Chinese automaker SAIC Motor Corp.'s new hybrid vehicle models, both scheduled to debut in 2010. A123's plants are also expected to produce batteries for smart grid applications and grid stabilization.

Beyond providing capital, GE, through GE Global Research, provided system design expertise and supported A123's stationary power product development for electric grid applications, and helped to design battery system components for A123' automotive programs.

"The advanced battery market is at a tipping point, and our support of A123 marks the application of GE's resources at the right time to capture leadership in an essential new field," said Little. "Our resources, engineering and R&D capabilities will have the potential to play an important role as A123 scales up its operations at this critical juncture. I look forward to joining A123's Board of Directors and working closely with the company's experienced team."

GE's support of A123 is part of its initiatives on smart grid and ecomagination -- the company's commitment to help its customers meet their environmental challenges while expanding its own portfolio of cleaner energy products.

A123 was born out of the research labs of the Massachusetts Institute of Technology and was funded initially with a $100,000 grant from the US Department of Energy in 2001. Among the companies using A123 batteries, battery systems and technology in the fields of transportation, grid energy storage and portable power are AES, BAE Systems, Better Place, Black and Decker, Cessna, Chrysler, Daimler, Delphi, Duke Energy, General Motors, Google.org, LADWP, Madison Gas and Electric, Magna Steyr, Mercedes Benz High Performance Engines, Procter and Gamble, Sempra and Volvo Truck. Other investors in this round of funding include Conoco Phillips, Detroit Edison, Espirito Santo Ventures, North Bridge, CMEA, Alliance Bernstein, Qualcomm, Sequoia, Novus and MIT.

About A123Systems

A123Systems develops and manufactures advanced lithium-ion batteries and battery systems for the transportation, electric grid services and portable power markets. Founded in 2001 and headquartered in Massachusetts, A123 Systems' proprietary nanoscale electrode technology is built on initial developments from the Massachusetts Institute of Technology. For additional information please visit www.a123systems.com.

About GE Energy Financial Services

GE Energy Financial Services' experts invest globally with a long-term view, backed by the best of GE's technical know-how, financial strength and rigorous risk management, across the capital spectrum, in one of the world's most capital-intensive industries, energy. GE Energy Financial Services helps its customers and GE grow through new investments, strong partnerships and optimization of its more than $22 billion in assets. In renewable energy, GE Energy Financial Services is growing its portfolio of more than $4 billion in assets in wind, solar, biomass, hydro and geothermal power. GE Energy Financial Services is based in Stamford, Connecticut. For more information, visit www.geenergyfinancialservices.com.

About GE Capital, Equity

GE Capital's Equity team works with GE operating businesses in the industrial, infrastructure, media, communications, healthcare, energy, and financial services sectors on private equity investment opportunities.

About GE

GE is a diversified global infrastructure, finance and media company that is built to meet essential world needs. From energy, water, transportation and health to access to money and information, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit the company's Web site at http://www.ge.com. GE is Imagination at Work.

A123 Systems is still waiting for an answer from federal and state governments on how much, if any, money it will get through the ATVM loan program and stimulus funds for green technology projects. In the meantime, A123 is moving ahead with plans to build a factory in Michigan that will produce automotive lithium ion cells and modules. The A123 press release is after the jump.

[Source: A123 Systems]

PRESS RELEASE:

GE Deepens Relationship with Battery Manufacturer A123Systems Through New Investment and Planned Addition of GE's Technology Head to Board of Directors

A123 Raises $69 Million in New Round of Private Financing

Watertown, MA – April 13, 2009 – A123Systems announced today it has raised $69 million from GE (GE: NYSE) and other investors to accelerate the expansion of its US lithium ion battery manufacturing and smart grid capabilities. The capital will help create new jobs by expanding A123's facilities in Hopkinton, MA, and Novi, MI, as well as build planned new factories in Michigan. The funding will also support A123's efforts to develop applications for the smart grid, such as utility-scale energy storage. Mark Little, GE's Senior Vice President and Director GE Global Research, will join A123's board of directors.

GE Energy Financial Services and GE Capital's Equity unit provided $15 million of the amount raised by A123 in this financing. This is GE's seventh investment in A123, making it the company's largest cash investor and bringing GE's cumulative investment to $70 million – increasing its ownership stake to more than ten percent.

In addition to the private capital, A123 is seeking funds under federal and state stimulus and other programs to ramp up its production capabilities in Michigan. The company's planned production facilities would be capable of supplying battery systems for five million hybrid electric vehicles or a half-million plug-in electric vehicles per year by 2013.

"We've accelerated our plans to expand our US manufacturing. We do not believe our country can afford to wait to develop advanced batteries," said David Vieau, A123Systems' President and Chief Executive Officer. "With this financing, we will begin an expansion that we expect to accelerate upon receipt of government funds. This expansion would create jobs and enable innovation."

"A123 has broken through many technical and engineering barriers to advance lithium ion batteries to commercial applications," said GE Chairman of the Board and CEO Jeff Immelt. "As a company also focused on technology innovation, GE is excited to expand our relationship with this close and long-time partner. GE's capital, resources and technology expertise will help A123 scale up faster and more efficiently."

The manufacturing plants are expected to produce battery cells and systems to meet the needs of A123's broad automotive customer portfolio, which includes several vehicle manufacturers and 19 vehicle models -- ranging from hybrid electric vehicles to electric vehicles. A123 was recently awarded battery development and supply contracts for Chrysler's first generation electric vehicle line-up and the Chinese automaker SAIC Motor Corp.'s new hybrid vehicle models, both scheduled to debut in 2010. A123's plants are also expected to produce batteries for smart grid applications and grid stabilization.

Beyond providing capital, GE, through GE Global Research, provided system design expertise and supported A123's stationary power product development for electric grid applications, and helped to design battery system components for A123' automotive programs.

"The advanced battery market is at a tipping point, and our support of A123 marks the application of GE's resources at the right time to capture leadership in an essential new field," said Little. "Our resources, engineering and R&D capabilities will have the potential to play an important role as A123 scales up its operations at this critical juncture. I look forward to joining A123's Board of Directors and working closely with the company's experienced team."

GE's support of A123 is part of its initiatives on smart grid and ecomagination -- the company's commitment to help its customers meet their environmental challenges while expanding its own portfolio of cleaner energy products.

A123 was born out of the research labs of the Massachusetts Institute of Technology and was funded initially with a $100,000 grant from the US Department of Energy in 2001. Among the companies using A123 batteries, battery systems and technology in the fields of transportation, grid energy storage and portable power are AES, BAE Systems, Better Place, Black and Decker, Cessna, Chrysler, Daimler, Delphi, Duke Energy, General Motors, Google.org, LADWP, Madison Gas and Electric, Magna Steyr, Mercedes Benz High Performance Engines, Procter and Gamble, Sempra and Volvo Truck. Other investors in this round of funding include Conoco Phillips, Detroit Edison, Espirito Santo Ventures, North Bridge, CMEA, Alliance Bernstein, Qualcomm, Sequoia, Novus and MIT.

About A123Systems

A123Systems develops and manufactures advanced lithium-ion batteries and battery systems for the transportation, electric grid services and portable power markets. Founded in 2001 and headquartered in Massachusetts, A123 Systems' proprietary nanoscale electrode technology is built on initial developments from the Massachusetts Institute of Technology. For additional information please visit www.a123systems.com.

About GE Energy Financial Services

GE Energy Financial Services' experts invest globally with a long-term view, backed by the best of GE's technical know-how, financial strength and rigorous risk management, across the capital spectrum, in one of the world's most capital-intensive industries, energy. GE Energy Financial Services helps its customers and GE grow through new investments, strong partnerships and optimization of its more than $22 billion in assets. In renewable energy, GE Energy Financial Services is growing its portfolio of more than $4 billion in assets in wind, solar, biomass, hydro and geothermal power. GE Energy Financial Services is based in Stamford, Connecticut. For more information, visit www.geenergyfinancialservices.com.

About GE Capital, Equity

GE Capital's Equity team works with GE operating businesses in the industrial, infrastructure, media, communications, healthcare, energy, and financial services sectors on private equity investment opportunities.

About GE

GE is a diversified global infrastructure, finance and media company that is built to meet essential world needs. From energy, water, transportation and health to access to money and information, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit the company's Web site at http://www.ge.com. GE is Imagination at Work.

Sign in to post

Please sign in to leave a comment.

Continue