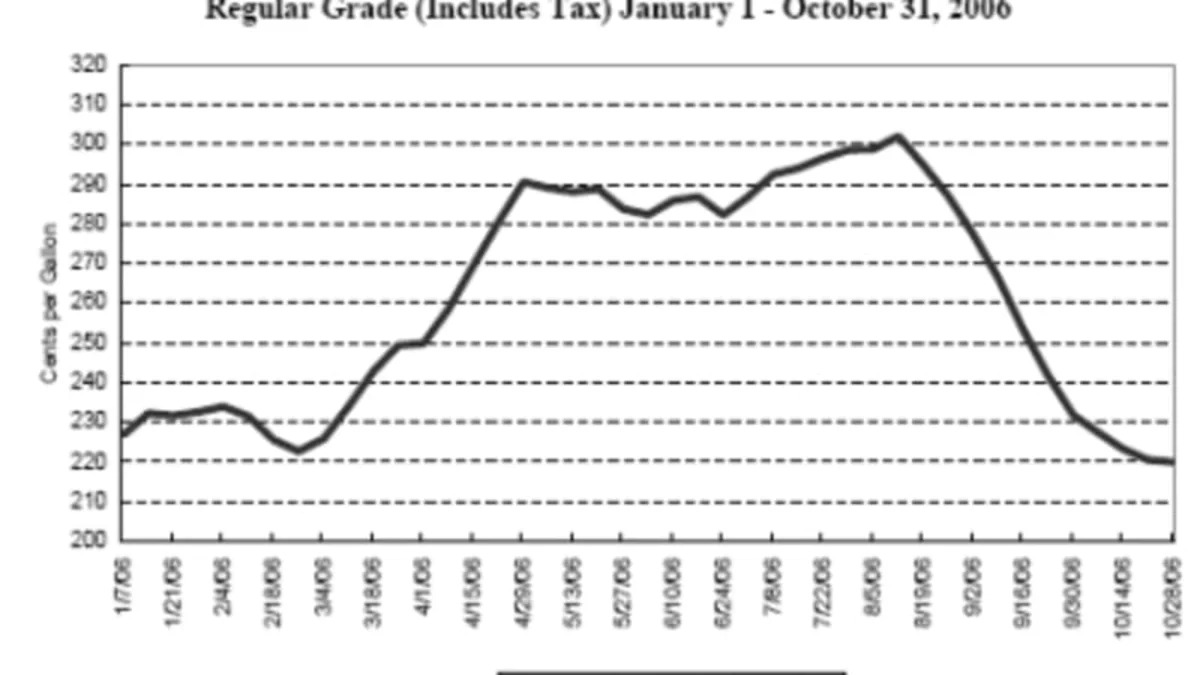

The FTC released a report with the reasons behind the gas price increase in 2006. Live in a cave and don't recall the increase in gas price in 2006? As shown in the above graph, the weekly average gas price started the year at $2.28 in February. It quickly rose to an average May to September of $2.90, an increase of .62, peaking at $3.02 in August. 42 percent of Americans thought Bush did it.

The FTC report gives 6 reasons for the increase in oil prices. 1. Summer demand. 2. Price of crude. 3. Price of ethanol. The FTC says the first 3 account for .47 of the .62 increase and were easy to calculate. The last 3, .15 of the .62 increase, are more complicated and exact impact on price harder to calculate. 4. Transition from MTBE to ethanol 5. Refinery problems and finally 6. Demand that's not seasonal. Go below the fold to read more.

[Source: Bloomberg, FTC] 1. Summer demand. The average increase in seasonal demand 2001 to 2005 was .14. The increase 2004 to 2005 was .21. Therefore, the so called gasoline spread for 2006 is .14-.21 of the .62 increase. Seems an odd way to calculate demand to me but whatever.

2. Price of crude. The price of crude went from $61.63 in February, to an average May to September of $72.34, up $10.71. The production cost increase and expected cost to the consumer is therefore .26.

3. The price of ethanol. The price of ethanol increased .62 May to August. Ethanol only makes up 3.7 percent of gas by volume. Therefore the cost increase due to ethanol is 0.023. Yes, the report actually included the the third decimal place.

Summer demand .14-.21 + .26, price of crude + .023, price of ethanol = about .47 or 75 percent of the increase. The remaining .13-.20 or 25 percent is not so simple because of things like foreign refiners. By itself, the reduction in refinery capacity of 2.5-4.1 percent would mean an increase of $1.35-$2.21. BUT Imports increased keeping the impact to just .13-.20.

Of the 2.5-4.1 percent in decreased capacity, .6-.8 were due to 4. Transition to ethanol from MTBE. 5. The remaining reductions were due to outages, transition low sulfur and other refinery problems. Finally, 6. Demands other than seasonal. There were increases in population and the number of average miles driven. Even with price increases, non-seasonal demand was also higher.

So, that's it. That's why gas was $3 last year. Turns out it was not Bush. This is AutoblogGreen, so I feel I have to say 85 mentions of ethanol in the 27 page report seemed a bit excessive. Oil was mentioned just 43 times. Assuming refinery problems accounts for the entire .13-.20, which it probably could not, worst case is the total impact of ethanol much less than a nickel. Why mention it so prominently FTC?

The FTC report gives 6 reasons for the increase in oil prices. 1. Summer demand. 2. Price of crude. 3. Price of ethanol. The FTC says the first 3 account for .47 of the .62 increase and were easy to calculate. The last 3, .15 of the .62 increase, are more complicated and exact impact on price harder to calculate. 4. Transition from MTBE to ethanol 5. Refinery problems and finally 6. Demand that's not seasonal. Go below the fold to read more.

[Source: Bloomberg, FTC] 1. Summer demand. The average increase in seasonal demand 2001 to 2005 was .14. The increase 2004 to 2005 was .21. Therefore, the so called gasoline spread for 2006 is .14-.21 of the .62 increase. Seems an odd way to calculate demand to me but whatever.

2. Price of crude. The price of crude went from $61.63 in February, to an average May to September of $72.34, up $10.71. The production cost increase and expected cost to the consumer is therefore .26.

3. The price of ethanol. The price of ethanol increased .62 May to August. Ethanol only makes up 3.7 percent of gas by volume. Therefore the cost increase due to ethanol is 0.023. Yes, the report actually included the the third decimal place.

Summer demand .14-.21 + .26, price of crude + .023, price of ethanol = about .47 or 75 percent of the increase. The remaining .13-.20 or 25 percent is not so simple because of things like foreign refiners. By itself, the reduction in refinery capacity of 2.5-4.1 percent would mean an increase of $1.35-$2.21. BUT Imports increased keeping the impact to just .13-.20.

Of the 2.5-4.1 percent in decreased capacity, .6-.8 were due to 4. Transition to ethanol from MTBE. 5. The remaining reductions were due to outages, transition low sulfur and other refinery problems. Finally, 6. Demands other than seasonal. There were increases in population and the number of average miles driven. Even with price increases, non-seasonal demand was also higher.

So, that's it. That's why gas was $3 last year. Turns out it was not Bush. This is AutoblogGreen, so I feel I have to say 85 mentions of ethanol in the 27 page report seemed a bit excessive. Oil was mentioned just 43 times. Assuming refinery problems accounts for the entire .13-.20, which it probably could not, worst case is the total impact of ethanol much less than a nickel. Why mention it so prominently FTC?

Sign in to post

Please sign in to leave a comment.

Continue