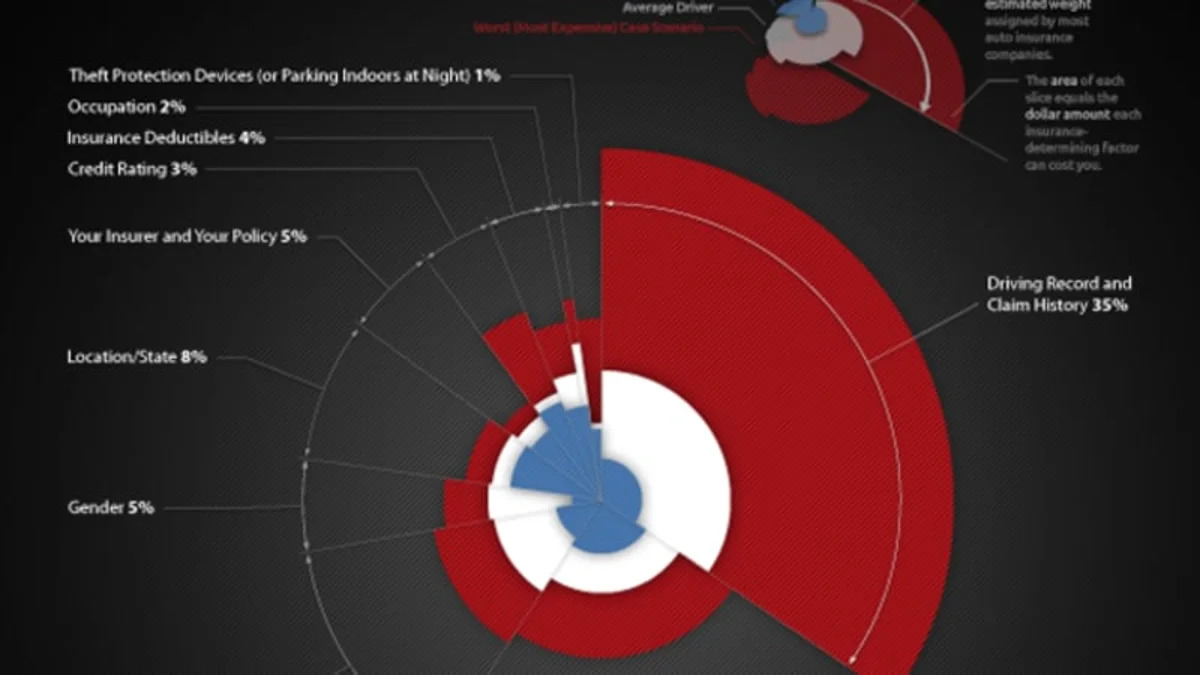

Car insurance rate infographic – Click above to view in high-res

Car insurance rates are determined with a host of factors in mind. Objective items like a motorist's age and driving record are the most-weighted factors insurers consider, but those items among a couple of dozens of things used to figure out what your premiums will be. Included in the CarInsurance.com graphic are stats like 2010's most-expensive car to insure, the Porsche 911 GT2, and the least, the Mazda Tribute.

Behind driving record, age and marital status are factors like what you drive, your gender, your state and credit rating. While lots of the factors are things drivers have some control over, a small part of the insurance rate you pay comes down to what company you choose to go with and which policy you buy. Follow the jump for an expanded breakdown of insurance costs.

[Source: CarInsurance.com]

[Infographic] Car Insurance Rates and Average Price of Car Insurance

Sign in to post

Please sign in to leave a comment.

Continue