Once upon a time, Ford Motor Company's advertising bore the tagline "Ford has a better idea." Recent events indicate that it may be time to resurrect that slogan.

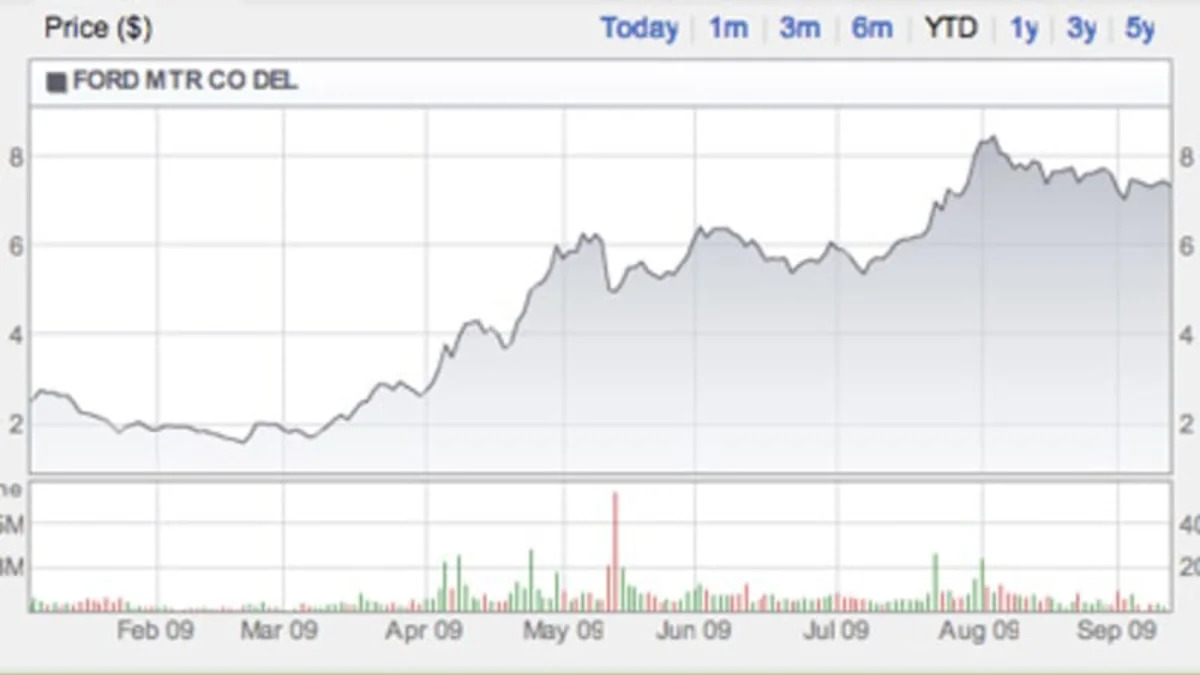

Cash for Clunkers, the bizarre promotion mounted by the U.S. Government on behalf of the country's wobbly auto industry, appears to vindicate Ford's biggest idea of the past few years: borrowing private capital instead of taxpayer cash to see it through a downturn. Not only did Ford sales soar during the month-long program, Ford products are appearing on more shopping lists.

Make no mistake, Ford mortgaged itself heavily in order to raise needed cash, but that decision, led by then-new CEO Alan Mulally, now stands as Ford's best idea in years. Among other advantages, it allowed the company to make its own decisions about new products, reorganization and personnel changes. This saved Ford a lot of time that would otherwise have been expended searching for the correct hat to put in Mulally's hands for use as a begging device in Washington.

Just to illustrate the efficacy of calling your own tune instead of jobbing in an independent piper, Ford paid Mulally around $12 million in total compensation last year. In June of this year, the bankrupt remnants of the Chrysler Corporation paid $15 million to a financial advisory group, money that might have been better spent with the Hemlock Society.

Ford was of course an enthusiastic and highly successful participant in Cash for Clunkers, or C4C as it became known, rightly sensing that if one is to take government money, C4C was better than bailout bucks.

Here's a brief overview of C4C:

The program ran from July 24 to August 24, 2009, during which time nearly 700,000 vehicles were sold under its provisions. Because of industry record-keeping practices, this 700,000 is best considered in context with August sales--which totaled 1,262,189 cars and light trucks. This was only 12,000 vehicles more than last August, but there has been a dramatic shift toward smaller more efficient vehicles, a key goal of C4C.

Questions immediately arose as to how many clunkers might have been traded in without the C4C program, and how many of these sales were, in retail parlance, pulled forward. When we are able to tally September sales, we'll get a snapshot of how strong the questioners' case is or is not.

Here are some of the positive things that happened to Ford within the C4C frame of reference.

Ford placed two of its products, the Focus and the Escape, on the list of the top ten cars bought by buyers trading in clunkers. The other eight entries were Asians, led by Toyota and Honda. That performance set Ford apart from the other domestic brands, but remember the list applies only to clunker trades.

While the Chevrolet brand was losing market share in August, Ford gained. Mind you, these are one-month year-over-year figures, but Ford's share of the light vehicle market rose from 10.6 to 12.8 percent even as Chevrolet's sank from 14.8 percent to 13.3 percent. A percent--or point--of market share in the auto industry is generally considered to be worth $2.8 billion over a year. Even in an awful year--such as this one--a point improvement means more than 100,000 added sales.

In other good news for the Blue Oval, the most recent J.D. Power quality study found all Ford brands continuing to improve at a faster rate than the industry norm. Ford initial quality improved for the eighth straight year, and the F150, Edge, Mustang and Mercury Sable led their segments.

People are obviously paying attention. George Pipas, Ford's lead sales analyst, told the press that consideration by buyers for Ford vehicles was up an impressive 17 percent since the first of the year.

In August, Ford saw a 21-percent rise in its retail sales overall, which indicates a diminishing reliance on unprofitable fleet sales. Ford has gained retail market share in 10 of the last 11 months.

Also in August, Ford Edge sales were up 9 percent, cheering enough, but there was far better news: Escape sales rose 49 percent, Focus sales were up 56 percent, Flex sales by 107 percent and Fusion improved by 132 percent. Overall company sales were 176,323, up 17 percent from August of 2008.

What may have been the best news of all came unexpectedly from Consumer Reports. It was good news for the domestic industry and even better news for Ford. For openers, 81 percent of potential new-vehicle buyers surveyed by the authoritative publication said they would consider a domestic vehicle. Ford's consideration rose by 17 percent (matching the rise cited above by George Pipas) while GM's consideration number advanced by only 6 percent. Chrysler's percentage declined by 25 percent from a year ago.

Rik Paul, CR's automotive editor, noted that the Detroit Three had been in the spotlight all year and said, "Ford was the only one of the Detroit Three that did not seek federal assistance, and this has likely helped bolster its reputation among car buyers."

This reflects the opinions of such non-automotive commentators as General George Patton, who famously said that Americans love a winner and hate a loser. Forget about sympathy for the underdog.

But work remains to be done. Of buyers who opted for Asian or European vehicles, the single biggest reason for not considering a Ford was that they did not find the products appealing. There's been progress, but there's always room for more.

Until the economy has put more distance between itself and the woods, Ford should not take to the streets of Dearborn to do a Gene Kelly dance turn, but it can properly allow itself a discreet smile of satisfaction. It might even draw on another old Ford advertising slogan and ask with confidence, "Have you driven a Ford lately?"

Sign in to post

Please sign in to leave a comment.

Continue