By Rick Newman / Yahoo Finance senior columnist

It’s a politicized country, so every problem must have a political origin. And if you’re the U.S. president when gasoline prices soar above $4 per gallon, you’ve got some explaining to do.

But President Biden has not caused the current spike in gas prices, even though critics put the blame on him. It’s true that Biden is no friend of the U.S. oil and gas industry. His plan to move from fossil fuels to renewables would marginalize oil and gas, and probably dent industry profits over time. But Biden’s energy and climate plans are nowhere near fruition, and meanwhile economic forces, not political ones, are causing tight oil supplies and pushing prices upward.

“Biden administration policies haven’t really done anything to reduce U.S. oil production,” Raoul LeBlanc, vice president of the energy practice at S&P Global, told Yahoo Finance. “They may do so in the future. But right now, that’s not the root of the reason U.S. oil and gas production is not ramping up.”

So what is pushing oil and gas prices up? Mainly it’s an effort by oil firms in the United States and elsewhere to resist overproducing, which has torpedoed profits many times in the past and, here in the U.S., caused billions of dollars in losses for oil producers and their investors. Russia’s invasion of Ukraine and the resulting sanctions have limited oil supplies from Russia, the world’s third-largest producer, accounting for a 20% price spike since Russia invaded on Feb. 24. But supply was tightening and oil prices were rising before then, as drillers worldwide adapted to a world weaning itself off fossil fuels. Since oil accounts for more than half the cost of gasoline, gas prices rise and fall in tandem with oil prices.

Americans casually familiar with hydraulic fracturing, the new drilling technology that led to a surge in U.S. oil and gas production starting around 2010, may think ample energy sources now mean American firms can drill for oil and gas at will. What many forget is that U.S. oil and gas drilling is a private-sector industry —not a government ministry — and drillers still need to make a profit. For much of the past decade, they failed to do that.

Producers continued to expand despite plunging profits

Several years of oversupply, culminating in 2020, led to plunging oil prices, widespread losses and an industrywide determination not to get burned again. From 2011 to 2014, U.S. oil prices averaged $95 per barrel and drillers cashed in. But exuberance led to overproduction, and oil prices sank. From 2015 to 2019, prices averaged just $53 per barrel. Profits plunged, but many producers continued to expand, much as startups like Uber or Tesla would tolerate losses for the sake of scale and market dominance, expecting the profits to come later.

[Follow Rick Newman on Twitter, sign up for his newsletter or send in your thoughts.]

Then in 2020, the pandemic downturn brought a crash so brutal that oil prices turned negative for a short time. The average price for the year was $39. For six years, drivers enjoyed remarkably low gas prices, which went as low as $1.72 in 2016 and $1.77 in 2020. Oil and gas drillers got crushed, however. Texas law firm Haynes and Boone has documented more than 600 oil and gas bankruptcies since 2016, with those firms defaulting on more than $321 billion in debt.

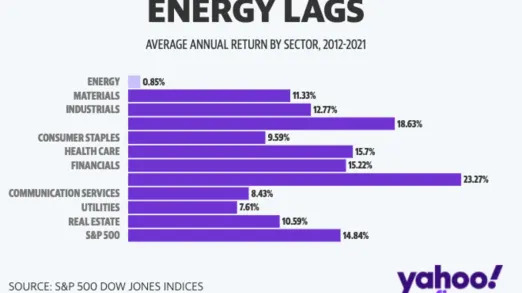

One way to see the wipeout is the market performance of the energy industry during the last 10 years—which is the worst among 11 sectors comprising the S&P 500 index. From 2012 through 2021, the average gain on energy stocks was just 0.85% per year. The average gain for the S&P 500 index was 14.8% during the same time. In five of those 10 years, the energy sector was the worst performer out of 11. The worst losses came in 2020, when energy stocks fell 37% and underperformed the S&P 500 by 53 percentage points.

Put another way, energy stocks lost so much value that they represent just 4.1% of the S&P 500 stock index today, down from 12.3% in 2011. Energy investors got the growth they were after, with U.S. oil production more than doubling during the last decade. What was missing were the profits.

A shift away from a growth-at-any-cost model

That has forced the oil and gas industry away from a growth-at-any-cost model, where large profits down the road will more than offset losses today. The market share of fossil fuels as an energy source now seems destined to shrink as the world becomes more determined to address global warming and reduce carbon emissions. Biden is just one of many world leaders pushing for new policies to reduce fossil-fuel use. In the private sector, giant investors such as BlackRock are pressuring companies in every industry to reduce carbon consumption and cut emissions. Tesla became the world’s most valuable car company not because of government mandates, but because consumers crave its electric vehicles and investors think it’s the wave of the future.

In the oil and gas industry, that has led to a new focus on short-term profitability, with the value of drilling operations more than five years into the future hard to predict.

“These guys don’t want to fire up because they don’t want to throw their business model out the window and lose all the credibility they’ve built with investors,” says LeBlanc. “They’re also very hesitant about revving up the engine in an inflationary environment. Costs would go through the roof, and they’re worried about getting sucker-punched by the market when prices come back down.”

-

Autoblog's Cheap Gas Prices Near Me finder tool

If energy companies were eager to drill, a la 2015, then Biden’s policies might crimp supply, eventually. The Biden administration has halted new leases for oil and gas drilling permits on federal land, pending the outcome of litigation involving how to price the cost of damage caused by carbon emissions. Biden has reversed a Trump-era decision to open up vast new areas in Alaska to drilling. Some Democrats in Congress want to repeal longstanding tax breaks for fossil-fuel drillers and replace them with green-energy tax breaks that would disadvantage the oil and gas industry.

But permits and financial incentives are usually long-term issues that have no effect on production today. New wells on land typically take at least six months to get fuel to market, and development of offshore rigs can take five years or more.

“The amount of oil and gas leasing the Biden administration has done makes absolutely no difference in the amount of oil and gas we’re producing right now,” says Samantha Gross, director of the energy security and climate initiative at the Brookings Institution. “These things take a while. The industry tends to have a backlog they’re figuring out what to do with.”

Can Biden do anything to boost production?

Biden has hardly shut down drilling, either. In its first year, the Biden administration issued more than 3,500 drilling permits, the most since the George W. Bush administration. Climate activists have criticized Biden for allowing too much drilling and abandoning some of his green-energy pledges. The Biden White House points out that drillers already have more than 9,000 permits they’re not acting on. Even energy executives acknowledge the industry has enough access to energy to drill for years.

Federal drilling permits are something of a canard, anyway. They’re only needed for drilling on federal land and in offshore waters, which accounts for just one-fourth of U.S. oil production. The other 75% takes place on private land where federal permits aren’t required. Drillers do need state permits to drill on private land, but that’s obviously not something Biden can control.

Permian Basin oil workers March 12 near Stanton, Texas. (Getty Images)

Is there anything Biden could do to boost U.S. oil production and lower gasoline prices? Samantha Gross of Brookings says Biden is already doing two things that can make a difference—releasing oil from the U.S. strategic reserve and jawboning nations with spare capacity, namely Saudi Arabia and the United Arab Emirates, to produce more. If Biden were to soften his rhetoric toward U.S. producers, that might help a bit, too.

“He could reassure oil producers,” Gross says. “Tell them, I know I’m getting flack from the far left, but I understand we need to feed the system we have now. It’s not nothing.”

Buddy Clark, co-chair of the energy practice at Haynes and Boone, says the federal government might help boost production at existing fields if it could speed the approval process for things like interstate pipelines and export facilities.

“Anything crossing state lines has to have [government] approval, so the [government] could expedite applications for building pipeline capacity,” Clark told Yahoo Finance. The process would still be cumbersome, however, and any federal help would probably boost the supply of natural gas more than oil.

With oil prices double what they were a year ago, U.S. drillers aren’t standing completely still. The number of operational rigs is up 61% from a year ago. The U.S. Energy Information Administration forecasts that U.S. oil production will rise by 7% this year and another 5% next year. If so, 2023 U.S. oil production would hit 12.6 million barrels per day, a new record.

More important for the industry, however, is sustained profitability. “A lot of investors became disenchanted with the oil and gas industry in terms of return on investment,” says Clark. “The health of the industry now is much better than it has been for the last six years.”

Drillers would like to keep it that way, regardless of how much drivers pay for gas.

----

Rick Newman is the author of four books, including "Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. You can also send confidential tips.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn

Sign in to post

Please sign in to leave a comment.

Continue