It's fair to say that most consumers would prefer a green vehicle, one that has a lower impact on the environment and goes easy on costly fuel (in all senses of the term). The problem is that most people can't – or won't – pay the price premium or put up with the compromises today's green cars demand. We're not all "cashed-up greenies."

AutoTrader conducted a recent survey of 1,900 millennials (those born between 1980 and 2000) about their new and used car buying habits. Isabelle Helms, AutoTrader's vice president of research, said millennials are "big on small" vehicles, which tend to be more affordable. Millennials also yearn for alternative-powered vehicles, but "they generally can't afford them."

When it comes to the actual behavior of consumers, the operative word is "affordable," not "green." In 2012, US new car sales rose to 14.5 million. But according to Manheim Research, at 40.5 million units, used car sales were almost three times as great. While the days of the smoke-belching beater are mostly gone, it's a safe bet that the used cars are far less green in terms of gas mileage, emissions, new technology, etc., than new ones.

Who Pays the Freight?

Green cars, particularly alternative-fuel green cars, cost more than their conventional gas-powered siblings. A previous article discussed how escalating costs and limited utility drove me away from leasing a hydrogen fuel cell-powered Hyundai Tucson, which at $50,000, was nearly twice the cost of the equivalent gas-powered version. In Hyundai's defense, it's fair to ask who should pay the costs of developing and implementing new technology vehicles and the infrastructure to support them. Hyundai hasn't released their costs on the car, but even at $50,000 they may well be taking a loss on every FCV they lease. California's goal is to have 1.5 million zero-emission vehicles on the road by 2025. Toyota's handsome new $70,000 fuel cell vehicle may soon be among these vehicles. Yet a Toyota spokesman had to insist, "This is not a compliance car" designed just to meet California's zero-emission rules.

When Toyota's entry arrives, it will join what were fewer than 280 hydrogen fuel cell vehicles in California last year. So how does California propose to break this classic chicken-and-egg,no fuel/no vehicle logjam? You guessed it: government subsidies. In 2013, Governor Jerry Brown signed into law Assembly Bill 8 requiring the California Energy Commission to spend up to $220 million on building up to 100 hydrogen fueling stations. So, for now at least, buy a Tesla, get a check. Buy a Volt, get a check. Buy a Leaf, get a check. Build a hydrogen filling station, get a check.

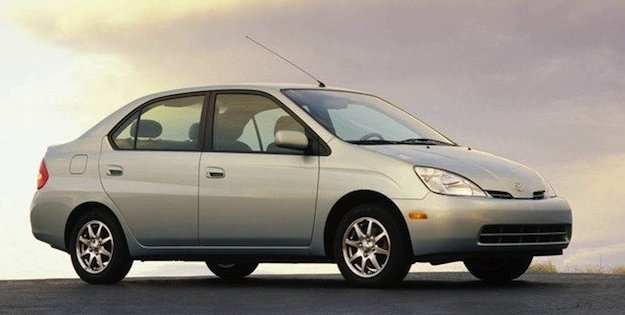

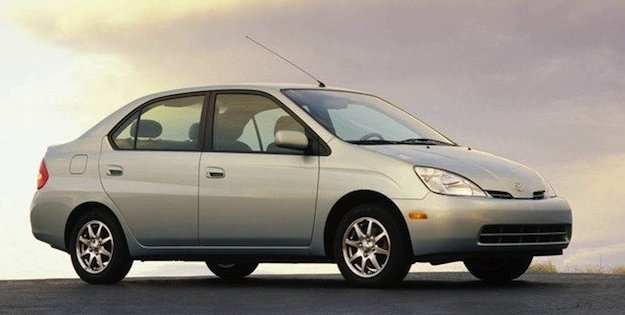

The Prius: A Controversial Commercial Success

Some 17 years after their introduction in Japan, Toyota hybrids in general and the Prius family in particular are a resounding success – if not financially, in terms of value to the brand's image, certainly. Toyota, with 25 hybrid passenger car models (including a plug-in) has sold more than six-million hybrid vehicles worldwide as of December 31, 2013. About 70 percent of those have been Prius variants. Toyota calculates that the use of Toyota hybrid vehicles has resulted in 41 million fewer tons of CO2 emissions than would have been emitted by similar gasoline-powered vehicles. Toyota also claims their hybrids have saved over 15 million kiloliters (roughly 3.9 billion gallons) of gasoline compared to comparable gasoline-only powered vehicles. That's all good news, along with the fact that several Prius and competitive hybrids delivering gas mileage in the 40+MPG range are priced below $25,000.

While it's hard to quantify the Japanese government's contribution, the US seems to believe that imitation is the sincerest form of flattery. In 2008, Congress enacted the Advanced Technology Vehicle Manufacturing program under the Department of Energy, providing $25 billion in grants, loans and other support. While Ford proudly notes it never took a government bailout, the company did borrow $5.9 billion of the $8.8 billion loaned to auto manufacturers under the program. Other loan recipients were Nissan ($1.6 billion), Tesla ($465 million) and (*cough-cough*) the late Fisker Automotive, which got $529 million. And let's not talk about A123 Systems, the battery manufacturer that went bankrupt and was eventually sold to Chinese interests after swallowing $250 million in taxpayer dollars. Tesla has been particularly adept in this area. In addition to the $465 million in federal money, Tesla has received several concessions from California, including a $35-million break last year on sales tax.

On the consumer level, it could be argued that if you can afford an $75,000 vehicle, you don't need a handout from the state or federal government. Yet that's exactly what Tesla buyers get. The incentive page of the Tesla website discusses the $7,500 US federal tax credit along with the $2,500 rebate from the California Clean Vehicle Rebate Project.

All these incentives are dwarfed by the just-announced $1.2 billion dollars in tax breaks Tesla will get from the state of Nevada in return for building its new $5-billion lithium battery plant, called the Gigafactory. The size of the breaks, including exempting Tesla from paying property or payroll taxes for up to ten years and from paying local sales or usage taxes for twenty, required a special legislative session.

In the end the package, which also provided Tesla electricity at discounted rates, passed the Nevada senate and legislature without a single "No" vote. However, many questioned the breaks during public comment. "Nobody pays my electric bill," noted a Las Vegas school teacher.

Trouble in Paradise: The End of Incentives?

This attracted the notice of California Senator Kevin De Leon. His State Bill 1275 recently passed the Assembly. He noted, "We need to invest in efforts to help make electric vehicles more accessible to residents in East Los Angeles, Fresno, Pomona and not just to the people of Beverly Hills and Malibu."

Under the bill, electric car buyers dubbed "low income" (under $60,000) would still get a $2,500 check from the state, but all other buyers would get a maximum $1,000. Lower-income buyers would also be eligible for an incentive to trade in their gas guzzler, which would then be scrapped. The bill's text also mentions an income cap, so it's possible that those able to buy a Tesla will no longer get a rebate. But if the incentives are phased out to the class of people who actually buy these vehicles, will sales collapse?

Autodata statistics show that Tesla Model S sales are down one percent this year, while sales of the Chevrolet Volt are down 12 percent. The only real growth story is Nissan's Leaf, which showed a 32-percent sales gain last month over the previous August. It's no surprise that the Leaf is one of the most affordable electric vehicles. And economics is clearly influencing sales in another way, with gas prices dropping to a national average below $3.45 a gallon.

Caldwell believes that lower gas prices, higher fuel efficiency for conventional cars, and the high prices for alternative fuel vehicles are putting a triple whammy on green car sales. Right now, she says, for consumers, "the math doesn't really work out."

Michael Goldstein is an automotive and general interest journalist who has written for the Los Angeles Times, LA Weekly, OC Weekly, NY Daily News, Car & Driver and many others. His article Blood Money was named best Investigative story in the 2013 Southern California Journalism Awards.

The truth is that most Americans can't afford a new car, green or not. In 2013, the average selling price of a new vehicle was $32,086. According to a recent Federal Reserve study, the median income for American families was $46,700 in 2013, a five-percent decline from $49,000 in 2010. While $32,000 for a car may not sound like a lot to some, it's about $630 a month financing for 48 months, assuming the buyer can come up with a $6,400 down payment. And that doesn't include gas, insurance, taxes, maintenance and all the rest. It's no wonder that a recent study showed that the average family could afford a new car in only one of 25 major US cities.In 2013, the average selling price of a new vehicle was $32,086.

AutoTrader conducted a recent survey of 1,900 millennials (those born between 1980 and 2000) about their new and used car buying habits. Isabelle Helms, AutoTrader's vice president of research, said millennials are "big on small" vehicles, which tend to be more affordable. Millennials also yearn for alternative-powered vehicles, but "they generally can't afford them."

When it comes to the actual behavior of consumers, the operative word is "affordable," not "green." In 2012, US new car sales rose to 14.5 million. But according to Manheim Research, at 40.5 million units, used car sales were almost three times as great. While the days of the smoke-belching beater are mostly gone, it's a safe bet that the used cars are far less green in terms of gas mileage, emissions, new technology, etc., than new ones.

Who Pays the Freight?

Green cars, particularly alternative-fuel green cars, cost more than their conventional gas-powered siblings. A previous article discussed how escalating costs and limited utility drove me away from leasing a hydrogen fuel cell-powered Hyundai Tucson, which at $50,000, was nearly twice the cost of the equivalent gas-powered version. In Hyundai's defense, it's fair to ask who should pay the costs of developing and implementing new technology vehicles and the infrastructure to support them. Hyundai hasn't released their costs on the car, but even at $50,000 they may well be taking a loss on every FCV they lease. California's goal is to have 1.5 million zero-emission vehicles on the road by 2025. Toyota's handsome new $70,000 fuel cell vehicle may soon be among these vehicles. Yet a Toyota spokesman had to insist, "This is not a compliance car" designed just to meet California's zero-emission rules.

So who will pick up the check? There are only three candidates: consumers, car manufacturers (and fuel and power companies on the infrastructure side) and state and federal government, also known as the taxpayers. Some consumers may be willing to pay more for greener, more efficient vehicles. Most cannot; a $12,000 Nissan Versa is much more accessible than a $30,000 Nissan Leaf. To push people towards these new technologies, the state and federal government has been stepping in to sweeten the pot.So who will pick up the check?

When Toyota's entry arrives, it will join what were fewer than 280 hydrogen fuel cell vehicles in California last year. So how does California propose to break this classic chicken-and-egg,no fuel/no vehicle logjam? You guessed it: government subsidies. In 2013, Governor Jerry Brown signed into law Assembly Bill 8 requiring the California Energy Commission to spend up to $220 million on building up to 100 hydrogen fueling stations. So, for now at least, buy a Tesla, get a check. Buy a Volt, get a check. Buy a Leaf, get a check. Build a hydrogen filling station, get a check.

The Prius: A Controversial Commercial Success

Some 17 years after their introduction in Japan, Toyota hybrids in general and the Prius family in particular are a resounding success – if not financially, in terms of value to the brand's image, certainly. Toyota, with 25 hybrid passenger car models (including a plug-in) has sold more than six-million hybrid vehicles worldwide as of December 31, 2013. About 70 percent of those have been Prius variants. Toyota calculates that the use of Toyota hybrid vehicles has resulted in 41 million fewer tons of CO2 emissions than would have been emitted by similar gasoline-powered vehicles. Toyota also claims their hybrids have saved over 15 million kiloliters (roughly 3.9 billion gallons) of gasoline compared to comparable gasoline-only powered vehicles. That's all good news, along with the fact that several Prius and competitive hybrids delivering gas mileage in the 40+MPG range are priced below $25,000.

Toyota's Prius is arguably the most successful green vehicle in the world, but it did not arrive like Athena springing full-grown from the skull of Zeus. Instead, as the blog Think Carbon put it, "Japan's dominance of the hybrid electric vehicle market is the result of a conscious decision by the Japanese Government and automakers to invest in an area of strategic national interest, exploit an area of comparative advantage and commit to a program of technology development spanning over three decades." Think Carbon notes that even after the launch of the first Prius in 1997, Japan's MITI "continued to provide financial support to HEVs by subsidizing half of the extra cost of an HEV compared to a comparable conventional vehicle." Auto executive Jim Press, who worked at Toyota for 37 years before becoming Chrysler vice chairman, got in hot water in 2008 when he said, "The Japanese government paid for 100-percent of the development of the battery and hybrid system that went into the Toyota Prius." A Toyota spokesman responded by saying that the company received no subsidy.The Prius is arguably the most successful green vehicle in the world, but it did not arrive like Athena springing full-grown from the skull of Zeus.

While it's hard to quantify the Japanese government's contribution, the US seems to believe that imitation is the sincerest form of flattery. In 2008, Congress enacted the Advanced Technology Vehicle Manufacturing program under the Department of Energy, providing $25 billion in grants, loans and other support. While Ford proudly notes it never took a government bailout, the company did borrow $5.9 billion of the $8.8 billion loaned to auto manufacturers under the program. Other loan recipients were Nissan ($1.6 billion), Tesla ($465 million) and (*cough-cough*) the late Fisker Automotive, which got $529 million. And let's not talk about A123 Systems, the battery manufacturer that went bankrupt and was eventually sold to Chinese interests after swallowing $250 million in taxpayer dollars. Tesla has been particularly adept in this area. In addition to the $465 million in federal money, Tesla has received several concessions from California, including a $35-million break last year on sales tax.

On the consumer level, it could be argued that if you can afford an $75,000 vehicle, you don't need a handout from the state or federal government. Yet that's exactly what Tesla buyers get. The incentive page of the Tesla website discusses the $7,500 US federal tax credit along with the $2,500 rebate from the California Clean Vehicle Rebate Project.

All these incentives are dwarfed by the just-announced $1.2 billion dollars in tax breaks Tesla will get from the state of Nevada in return for building its new $5-billion lithium battery plant, called the Gigafactory. The size of the breaks, including exempting Tesla from paying property or payroll taxes for up to ten years and from paying local sales or usage taxes for twenty, required a special legislative session.

In the end the package, which also provided Tesla electricity at discounted rates, passed the Nevada senate and legislature without a single "No" vote. However, many questioned the breaks during public comment. "Nobody pays my electric bill," noted a Las Vegas school teacher.

Trouble in Paradise: The End of Incentives?

While the median income of Americans hovers under $50,000, the median income of electric car buyers, according to an industry group, was $108,000 in 2012. A 2013 study by Experian found that 21 percent of electric car buyers had an income of over $175,000. Yet these are precisely the people who are getting federal and state breaks and cash rebates to buy alternative fuel vehicles. According to The Los Angeles Times, almost 80 percent of California rebates went to households earning $100,000 or more. Half of those getting rebates for Tesla's $70,000+ sedan earned at least $300,000.While the median income of Americans hovers under $50,000, the median income of electric car buyers is $108,000.

This attracted the notice of California Senator Kevin De Leon. His State Bill 1275 recently passed the Assembly. He noted, "We need to invest in efforts to help make electric vehicles more accessible to residents in East Los Angeles, Fresno, Pomona and not just to the people of Beverly Hills and Malibu."

Under the bill, electric car buyers dubbed "low income" (under $60,000) would still get a $2,500 check from the state, but all other buyers would get a maximum $1,000. Lower-income buyers would also be eligible for an incentive to trade in their gas guzzler, which would then be scrapped. The bill's text also mentions an income cap, so it's possible that those able to buy a Tesla will no longer get a rebate. But if the incentives are phased out to the class of people who actually buy these vehicles, will sales collapse?

A recent study by Edmunds analyst Jessica Caldwell showed that electrified vehicle sales (including traditional hybrids) have already stagnated, declining from 3.84 percent of all vehicles sold last year from January to August to 3.66 percent of all vehicles sold this year. The numbers of plug-in hybrids and battery-powered EVs did grow, year over year, from 28,241 plug-ins to 40,748. BEV sales grew from 29,917 vehicles to 40,349, although Caldwell describes the actual sales numbers as "a rounding error."If incentives are phased out to the class of people who actually buy these vehicles, will sales collapse?

Autodata statistics show that Tesla Model S sales are down one percent this year, while sales of the Chevrolet Volt are down 12 percent. The only real growth story is Nissan's Leaf, which showed a 32-percent sales gain last month over the previous August. It's no surprise that the Leaf is one of the most affordable electric vehicles. And economics is clearly influencing sales in another way, with gas prices dropping to a national average below $3.45 a gallon.

Caldwell believes that lower gas prices, higher fuel efficiency for conventional cars, and the high prices for alternative fuel vehicles are putting a triple whammy on green car sales. Right now, she says, for consumers, "the math doesn't really work out."

Michael Goldstein is an automotive and general interest journalist who has written for the Los Angeles Times, LA Weekly, OC Weekly, NY Daily News, Car & Driver and many others. His article Blood Money was named best Investigative story in the 2013 Southern California Journalism Awards.

Sign in to post

Please sign in to leave a comment.

Continue