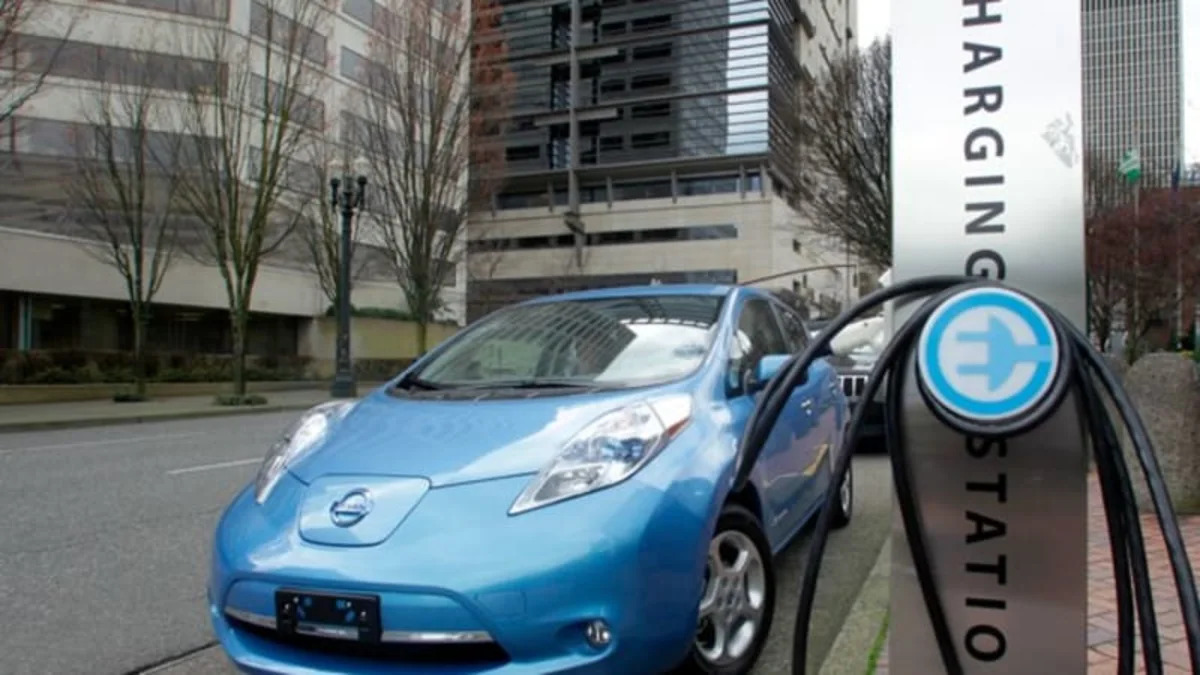

Frost & Sullivan has released a report stating that 4.1 million electric vehicle charging points will be in place in North America by 2017. The most common ones, 71 percent will be Level 1 charging stations for home charging, followed by level 2, which will account for 27 percent of the installed network (DC fast chargers will only make up a sliver of the total). To go along with the fact that most chargers will be private, nearly 87 percent of all electric vehicles are expected to be charged in residential locations, where they'll be parked in the garage for 10 to 12 hours in a day.

As stated, the report forecasts 4.1 million of these chargers being ready in five years. Wow! Okay, let's start with EV charging stations currently in place and do the numbers.

According to the U.S. Dept. of Energy's Alternative Fuels Data Center, there are currently a little bit more than 4,150 EV charging stations in the U.S. Statistics were not readily accessible on Canada and Mexico, but let's assume there are at least 500, bringing the North American total for public charging stations to about 4,600. Now, let's assume there are roughly 35,000 home charging stations installed since that's about how many Chevrolet Volt, Nissan Leaf and competitive models have been sold in the past couple of years. So, we figure, there could be about 40,000 charging stations currently installed in North America.

"The charging infrastructure is expected to grow at a compound annual growth rate (CAGR) of 128.12 percent, due to the currency of the 'green' concept and oil prices' volatility," according to the press release. Now, wait a minute. We calculated the CAGR from 40,000 to 4.1 million in five years and got 152.43 percent. Perhaps Frost & Sullivan is starting from a slightly higher number of installed chargers, but something seems to be missing here.

*UPDATE: We got a clarification from Frost & Sullivan's automotive and transportation research associate, Prajyot Sathe. He explained:

The study takes into consideration various factors that support the forecasted number of charging stations. They are as follows:

1. 4.1 million (cumulative) charging stations/spots are expected to be installed by 2017, which cover residential and public locations.

2. Public charging stations include installations in workplace, shopping malls, fleets and all types of public locations.

3. Every electric vehicle sold comes with a level 1 charging station/cable for residential charging which can be plugged in household outlets.

4. The CAGR has been considered from the base date of 2011 with 12,500 units to 4.1 million until 2017, which makes it 128%.

4. There are various other assumptions such as battery size, electric vehicle estimated sales, etc. behind the number of charging stations.

As stated, the report forecasts 4.1 million of these chargers being ready in five years. Wow! Okay, let's start with EV charging stations currently in place and do the numbers.

According to the U.S. Dept. of Energy's Alternative Fuels Data Center, there are currently a little bit more than 4,150 EV charging stations in the U.S. Statistics were not readily accessible on Canada and Mexico, but let's assume there are at least 500, bringing the North American total for public charging stations to about 4,600. Now, let's assume there are roughly 35,000 home charging stations installed since that's about how many Chevrolet Volt, Nissan Leaf and competitive models have been sold in the past couple of years. So, we figure, there could be about 40,000 charging stations currently installed in North America.

"The charging infrastructure is expected to grow at a compound annual growth rate (CAGR) of 128.12 percent, due to the currency of the 'green' concept and oil prices' volatility," according to the press release. Now, wait a minute. We calculated the CAGR from 40,000 to 4.1 million in five years and got 152.43 percent. Perhaps Frost & Sullivan is starting from a slightly higher number of installed chargers, but something seems to be missing here.

*UPDATE: We got a clarification from Frost & Sullivan's automotive and transportation research associate, Prajyot Sathe. He explained:

The study takes into consideration various factors that support the forecasted number of charging stations. They are as follows:

1. 4.1 million (cumulative) charging stations/spots are expected to be installed by 2017, which cover residential and public locations.

2. Public charging stations include installations in workplace, shopping malls, fleets and all types of public locations.

3. Every electric vehicle sold comes with a level 1 charging station/cable for residential charging which can be plugged in household outlets.

4. The CAGR has been considered from the base date of 2011 with 12,500 units to 4.1 million until 2017, which makes it 128%.

4. There are various other assumptions such as battery size, electric vehicle estimated sales, etc. behind the number of charging stations.

No. America Charging Infrastructure to Reach 4.1M Units By 2017

MOUNTAIN VIEW, Calif. -- The electric vehicle (EV) charging station market in North America has grown immensely, helped along by favorable government level (federal, state and municipal) incentives and subsidies for the purchase of EVs. The government is extending these plans to the installation of charging station and funding programs such as ECOtality's EV project, which is trying to install electric vehicle charging infrastructure in six major states.

New analysis from Frost & Sullivan ( http://www.automotive.frost.com ), Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure in North America, finds that there will be approximately 4.1 million charging points by 2017. The most common ones will be the level 1 charging stations, as every EV sold will have a level 1 charging cord included in the vehicle. Level 1 charging station can be plugged in a household socket which takes approximately 8 to 10 hours to charge the vehicle and does not involve any installation cost. About 71 percent of the charging stations are expected to be level 1 followed by level 2, which will account for 27 percent of the market share by 2017. Nearly 87 percent of the EVs are expected to be charged in residential locations, as they will be parked in the garage for 10 to 12 hours in a day.

If you are interested in more information on this research, please send an email to Jeannette Garcia, Corporate Communications, at jeannette.garcia@frost.com, with your full name, company name, title, telephone number, company email address, company website, city, state and country.

"EVs are more expensive than conventional vehicles, therefore, federal government is granting customers as much as $7,500 in incentives to purchase an EV," said Frost & Sullivan Research Associate Prajyot Sathe. "Incentives include discounts on the purchase of EVs, tax credits or exemption and other advantages such as usage of heavy occupancy vehicle (HOV) lanes and free parking."

The charging infrastructure is expected to grow at a compound annual growth rate (CAGR) of 128.12 percent, due to the currency of the 'green' concept and oil prices' volatility. Attracted by its potential and low entry barriers, participants are emerging from multiple industries such as technology, vehicle manufacturers, and utilities.

Even while offering substantial opportunities, the EV charging infrastructure market is plagued by issues typical to a nascent market. Participants are looking for solutions to ensure standardization of charging systems in vehicles, charging stations, and business models. EV owners are also inconvenienced by the low access to charging stations and the 8 to 10 hours needed to charge their vehicles at level 1.

However, continuous R&D will help overcome these challenges in the next two to three years. As the market is still evolving, participants are in the process of identifying the scope of development of technologies and economically viable business models.

"Participants are introducing various strategies such as providing EV charging facilities in restaurants, leisure places and malls as a value-added service to customers," said Sathe. "They also adopt various business models such as subscription and pay-per-use to attract more buyers and make the most out of the market's potential."

Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure in North America is part of the Automotive & Transportation Growth Partnership Services program, which also includes research in the following markets: Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure Market in Europe, Strategic Analysis of Electric Motor Technologies for Electric and Hybrid Vehicles in North America, and Strategic Analysis of Electric Motor Technologies for Electric and Hybrid Vehicles in Europe. All research services included in subscriptions provide detailed market opportunities and industry trends that have been evaluated following extensive interviews with market participants.

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today's market participants.

Our "Growth Partnership" supports clients by addressing these opportunities and incorporating two key elements driving visionary innovation: The Integrated Value Proposition and The Partnership Infrastructure.

The Integrated Value Proposition provides support to our clients throughout all phases of their journey to visionary innovation including: research, analysis, strategy, vision, innovation and implementation.

The Partnership Infrastructure is entirely unique as it constructs the foundation upon which visionary innovation becomes possible. This includes our 360 degree research, comprehensive industry coverage, career best practices as well as our global footprint of more than 40 offices.

For more than 50 years, we have been developing growth strategies for the global 1000, emerging businesses, the public sector and the investment community. Is your organization prepared for the next profound wave of industry convergence, disruptive technologies, increasing competitive intensity, Mega Trends, breakthrough best practices, changing customer dynamics and emerging economies?

MOUNTAIN VIEW, Calif. -- The electric vehicle (EV) charging station market in North America has grown immensely, helped along by favorable government level (federal, state and municipal) incentives and subsidies for the purchase of EVs. The government is extending these plans to the installation of charging station and funding programs such as ECOtality's EV project, which is trying to install electric vehicle charging infrastructure in six major states.

New analysis from Frost & Sullivan ( http://www.automotive.frost.com ), Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure in North America, finds that there will be approximately 4.1 million charging points by 2017. The most common ones will be the level 1 charging stations, as every EV sold will have a level 1 charging cord included in the vehicle. Level 1 charging station can be plugged in a household socket which takes approximately 8 to 10 hours to charge the vehicle and does not involve any installation cost. About 71 percent of the charging stations are expected to be level 1 followed by level 2, which will account for 27 percent of the market share by 2017. Nearly 87 percent of the EVs are expected to be charged in residential locations, as they will be parked in the garage for 10 to 12 hours in a day.

If you are interested in more information on this research, please send an email to Jeannette Garcia, Corporate Communications, at jeannette.garcia@frost.com, with your full name, company name, title, telephone number, company email address, company website, city, state and country.

"EVs are more expensive than conventional vehicles, therefore, federal government is granting customers as much as $7,500 in incentives to purchase an EV," said Frost & Sullivan Research Associate Prajyot Sathe. "Incentives include discounts on the purchase of EVs, tax credits or exemption and other advantages such as usage of heavy occupancy vehicle (HOV) lanes and free parking."

The charging infrastructure is expected to grow at a compound annual growth rate (CAGR) of 128.12 percent, due to the currency of the 'green' concept and oil prices' volatility. Attracted by its potential and low entry barriers, participants are emerging from multiple industries such as technology, vehicle manufacturers, and utilities.

Even while offering substantial opportunities, the EV charging infrastructure market is plagued by issues typical to a nascent market. Participants are looking for solutions to ensure standardization of charging systems in vehicles, charging stations, and business models. EV owners are also inconvenienced by the low access to charging stations and the 8 to 10 hours needed to charge their vehicles at level 1.

However, continuous R&D will help overcome these challenges in the next two to three years. As the market is still evolving, participants are in the process of identifying the scope of development of technologies and economically viable business models.

"Participants are introducing various strategies such as providing EV charging facilities in restaurants, leisure places and malls as a value-added service to customers," said Sathe. "They also adopt various business models such as subscription and pay-per-use to attract more buyers and make the most out of the market's potential."

Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure in North America is part of the Automotive & Transportation Growth Partnership Services program, which also includes research in the following markets: Strategic Technology and Market Analysis of Electric Vehicle Charging Infrastructure Market in Europe, Strategic Analysis of Electric Motor Technologies for Electric and Hybrid Vehicles in North America, and Strategic Analysis of Electric Motor Technologies for Electric and Hybrid Vehicles in Europe. All research services included in subscriptions provide detailed market opportunities and industry trends that have been evaluated following extensive interviews with market participants.

About Frost & Sullivan

Frost & Sullivan, the Growth Partnership Company, works in collaboration with clients to leverage visionary innovation that addresses the global challenges and related growth opportunities that will make or break today's market participants.

Our "Growth Partnership" supports clients by addressing these opportunities and incorporating two key elements driving visionary innovation: The Integrated Value Proposition and The Partnership Infrastructure.

The Integrated Value Proposition provides support to our clients throughout all phases of their journey to visionary innovation including: research, analysis, strategy, vision, innovation and implementation.

The Partnership Infrastructure is entirely unique as it constructs the foundation upon which visionary innovation becomes possible. This includes our 360 degree research, comprehensive industry coverage, career best practices as well as our global footprint of more than 40 offices.

For more than 50 years, we have been developing growth strategies for the global 1000, emerging businesses, the public sector and the investment community. Is your organization prepared for the next profound wave of industry convergence, disruptive technologies, increasing competitive intensity, Mega Trends, breakthrough best practices, changing customer dynamics and emerging economies?

Sign in to post

Please sign in to leave a comment.

Continue