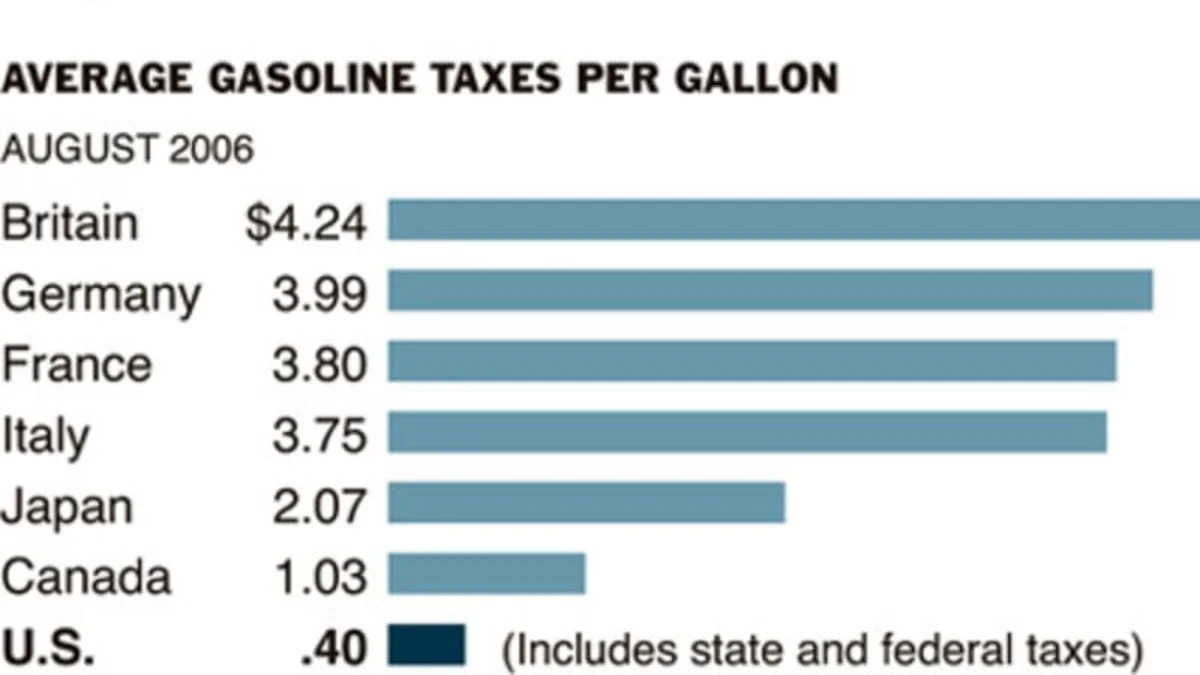

It's time to take a serious look at our country's federal gasoline tax. According to the New York Times, it's been set at 18.4 cents per gallon since 1993. This is FAR lower than any other industrialized nation. The article also points out that according to the International Energy Agency, America's overall gas taxes in August averaged just 40 cents per gallon while Britain and Germany were at $4.24 and $3.99, respectively.

Over the past 13 years a lot has changed. Just look at the Consumer Price Index (CPI). It has gone up 59.4 points during that time, meaning what would have been priced at $1.45 in 1993 would cost $2.04 today. Yet, the federal gas tax has remained rock steady. Earlier, Mike pointed out that the U.S. only consists of about 5 percent of the global population and yet consumes 25 percent of its oil, two-thirds of which is used for transportation. What happens when the rest of the world starts asking for its fair share? Peak oil, anyone?

There's more, like right-wing support and a touch of Pigovian economics, after the jump...

Left-leaning politicians and media figures have been calling for a higher federal gasoline tax for a while, but now we're beginning to hear more and more support for raising the gas tax from highly respected economists, top-level executives and well-known personalities on the right. Back in September we reported that Shell Oil Company president John Hofmeister denounced U.S. politicians for not organizing a strategy to combat global warming and called for federal policy changes to keep gas prices high. He argued that this would force market and behavioral changes facilitating the growth of a "culture of conservation." And last Sunday, the same New York Times article that we referred to earlier reported that among many other high-level Republican economists, former Federal Reserve Chairman Alan Greenspan told a group of business executives that he would like to see an increase in the federal gasoline tax. His simple reasoning is "that's the way to get consumption down. It's a national security issue." This comes from the same Alan Greenspan who manipulated the interest rate to keep inflation in check for nearly two decades, but always advocated low taxes, the lower the better.

So what's going on? Why are Republican economists starting to jump on the higher-gas-tax bandwagon? Daniel Gross, author of the New York Times article to which we've been referring, points to two possible reasons. The first of which has to do with the environment and climate change. He quotes Kenneth Rogoff, former chief economist at the International Monetary Fund and economics professor at Harvard, "The U.S. has reasonable arguments for not signing the Kyoto treaty, but we need to propose some other measure that will help reduce emissions." Perhaps, there's truth to the above statement as global climate change has enjoyed the international spotlight for some time now, but the second answer makes seems to make a little more sense - reducing America's dependence of foreign oil. Gross quotes Andrew A. Samwick, chief economist on the Council of Economic Advisers from 2003 to 2004, "Given the role that imported oil plays today, you can't continue to be a responsible economist and not talk about ways to reduce that dependence." Here, Gross adds that "free-market economists view a higher gas tax as a more elegant solution than, for example, raising auto efficiency standards."

So now that we're beginning to see broad support across the political spectrum for raising the federal gas tax, why aren't we moving forward with policy changes? That's a question best left for the Bush administration and your senators. Gross comments on the "professional hazard" that academic economists face when serving presidential administrations. Specifically, he says that they must act as "team players who value the overall success of the administration - even if they don't agree with all of its policies." I'm sure there's a strong degree of truth to that statement, however, I also don't think it's quite that simple. For every academic economist who supports Pigovian Taxes (or the concept of using taxes to correct imperfections in the market), it seems you can always find another who does not. (You can learn more about the battle between the Pigovian economists and their free-for-all counterparts on N. Gregory Mankiw's blog. He is a Harvard economist who also served as chairman of President Bush's Council of Economic Advisers from 2003 to 2005.)

We can spend the next two years advocating a higher federal gasoline tax, but what will it actually take to pass legislation and how long will it realistically take?

[Source: New York Times]

Over the past 13 years a lot has changed. Just look at the Consumer Price Index (CPI). It has gone up 59.4 points during that time, meaning what would have been priced at $1.45 in 1993 would cost $2.04 today. Yet, the federal gas tax has remained rock steady. Earlier, Mike pointed out that the U.S. only consists of about 5 percent of the global population and yet consumes 25 percent of its oil, two-thirds of which is used for transportation. What happens when the rest of the world starts asking for its fair share? Peak oil, anyone?

There's more, like right-wing support and a touch of Pigovian economics, after the jump...

Left-leaning politicians and media figures have been calling for a higher federal gasoline tax for a while, but now we're beginning to hear more and more support for raising the gas tax from highly respected economists, top-level executives and well-known personalities on the right. Back in September we reported that Shell Oil Company president John Hofmeister denounced U.S. politicians for not organizing a strategy to combat global warming and called for federal policy changes to keep gas prices high. He argued that this would force market and behavioral changes facilitating the growth of a "culture of conservation." And last Sunday, the same New York Times article that we referred to earlier reported that among many other high-level Republican economists, former Federal Reserve Chairman Alan Greenspan told a group of business executives that he would like to see an increase in the federal gasoline tax. His simple reasoning is "that's the way to get consumption down. It's a national security issue." This comes from the same Alan Greenspan who manipulated the interest rate to keep inflation in check for nearly two decades, but always advocated low taxes, the lower the better.

So what's going on? Why are Republican economists starting to jump on the higher-gas-tax bandwagon? Daniel Gross, author of the New York Times article to which we've been referring, points to two possible reasons. The first of which has to do with the environment and climate change. He quotes Kenneth Rogoff, former chief economist at the International Monetary Fund and economics professor at Harvard, "The U.S. has reasonable arguments for not signing the Kyoto treaty, but we need to propose some other measure that will help reduce emissions." Perhaps, there's truth to the above statement as global climate change has enjoyed the international spotlight for some time now, but the second answer makes seems to make a little more sense - reducing America's dependence of foreign oil. Gross quotes Andrew A. Samwick, chief economist on the Council of Economic Advisers from 2003 to 2004, "Given the role that imported oil plays today, you can't continue to be a responsible economist and not talk about ways to reduce that dependence." Here, Gross adds that "free-market economists view a higher gas tax as a more elegant solution than, for example, raising auto efficiency standards."

So now that we're beginning to see broad support across the political spectrum for raising the federal gas tax, why aren't we moving forward with policy changes? That's a question best left for the Bush administration and your senators. Gross comments on the "professional hazard" that academic economists face when serving presidential administrations. Specifically, he says that they must act as "team players who value the overall success of the administration - even if they don't agree with all of its policies." I'm sure there's a strong degree of truth to that statement, however, I also don't think it's quite that simple. For every academic economist who supports Pigovian Taxes (or the concept of using taxes to correct imperfections in the market), it seems you can always find another who does not. (You can learn more about the battle between the Pigovian economists and their free-for-all counterparts on N. Gregory Mankiw's blog. He is a Harvard economist who also served as chairman of President Bush's Council of Economic Advisers from 2003 to 2005.)

We can spend the next two years advocating a higher federal gasoline tax, but what will it actually take to pass legislation and how long will it realistically take?

[Source: New York Times]

Sign in to post

Please sign in to leave a comment.

Continue